UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

Form

Or

For the fiscal year ended

Or

Or

Date of event requiring this shell company report________________________

For the transition period from__________ to ___________

Commission File No.

(Exact name of Registrant as specified in its charter)

Can-Fite BioPharma Ltd., an Israeli Limited Company

(Translation of Registrant’s name into English)

(Jurisdiction of incorporation or organization)

(Address of principal executive offices)

Chief Executive, Financial and Operating Officer

Tel: +

Fax: +

(Name, Telephone, E-mail and/or Facsimile number and Address of Company Contact Person)

Securities registered or to be registered pursuant to Section 12(b) of the Act:

| Title of each class | Trading Symbol(s) | Name of each exchange on which registered | ||

Securities registered or to be registered pursuant

to Section 12(g) of the Act:

None

Securities for which there is a reporting obligation pursuant to Section 15(d) of the Act:

None

| * | Ordinary shares not for trading, but only in connection with the registration of the American Depositary Shares. |

Indicate the number of outstanding

shares of each of the issuer’s classes of capital or common stock as of the close of the period covered by the annual report (December

31, 2023):

Indicate by check mark if

the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes ☐

If this report is an annual

or transition report, indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or 15(d) of the

Securities Exchange Act of 1934. Yes ☐

Indicate by check mark whether

the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the

preceding 12 months (or for such a shorter period that the registrant was required to file such reports), and (2) has been subject to

such filing requirements for the past 90 days.

Indicate by check mark whether

the registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T

(§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit

such files).

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or an emerging growth company. See definition of “large accelerated filer,” “accelerated filer,” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

| Large accelerated filer | ☐ | Accelerated filer | ☐ | ☒ | |

| Emerging growth company |

If an emerging growth company that prepares its financial statements in accordance with U.S. GAAP, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards† provided pursuant to Section 13(a) of the Exchange Act ☐

Ϯ The term “new or revised financial accounting standard” refers to any update issued by the Financial Accounting Standards Board to its Accounting Standards Codification after April 5, 2012.

Indicate by check mark whether

the registrant has filed a report on and attestation to its management’s assessment of the effectiveness of its internal control

over financial reporting under Section 404(b) of the Sarbanes-Oxley Act (15 U.S.C. 7262(b)) by the registered public accounting firm that

prepared or issued its audit report.

If securities are registered

pursuant to Section 12(b) of the Act, indicate by check mark whether the financial statements of the registrant reflect the correction

of an error to previously issued financial statements.

Indicate by check mark whether any of those error corrections are restatements that required a recovery analysis of incentive-based compensation received by any of the registrant’s executive officers during the relevant recovery period pursuant to §240.10D-1(b). ☐

Indicate by check mark which basis of accounting the registrant has used to prepare the financial statements included in this filing:

| International Financial Reporting Standards | Other ☐ | |

| as issued by the International Accounting Standards Board ☐ |

If “Other” has been checked in response to the previous question, indicate by check mark which financial statement item the registrant has elected to follow. Item 17 ☐ Item 18 ☐

If this is an annual report,

indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes ☐ No

TABLE OF CONTENTS

i

INTRODUCTION

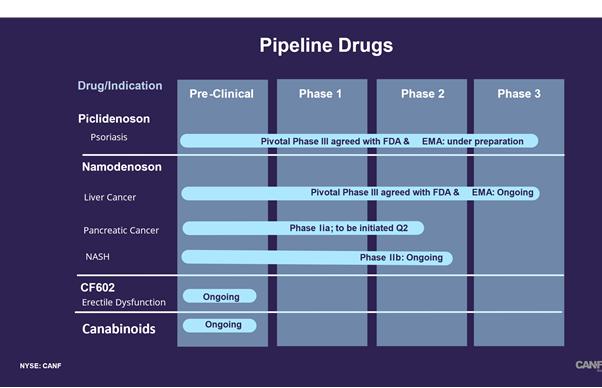

Can-Fite is a clinical-stage biopharmaceutical company that develops orally bioavailable small molecule therapeutic products for the treatment of cancer, liver and inflammatory diseases and erectile dysfunction. We are also developing specific formulations of cannabis components for the treatment of cancer, inflammatory, and metabolic diseases. Our platform technology utilizes the Gi protein associated A3 adenosine receptor, or A3AR, as a therapeutic target. A3AR is highly expressed in pathological body cells such as inflammatory and cancer cells, and has a low expression in normal cells, suggesting that the receptor could be a specific target for pharmacological intervention. Our pipeline of drug candidates are synthetic, highly specific agonists and allosteric modulators targeting the A3AR.

Our ordinary shares have been trading on the Tel Aviv Stock Exchange, or TASE, under the symbol “CFBI” since October 2005. On October 2, 2012, our ADSs began trading over the counter, or OTC, in the United States under the symbol “CANFY” and on November 19, 2013, our ADSs began trading on the NYSE American under the symbol “CANF.”

Unless otherwise indicated, all references to the “Company,” “we,” “our” and “Can-Fite” refer to Can-Fite BioPharma Ltd. and its consolidated subsidiary. References to “ordinary shares”, “ADSs”, “warrants” and “share capital” refer to the ordinary shares, ADSs, warrants and share capital, respectively, of Can-Fite.

References to “U.S. dollars”, “dollars”, “USD”, and “$” are to currency of the United States of America, and references to “NIS” are to New Israeli Shekels. References to “ordinary shares” are to our ordinary shares, no par value. We report financial information under generally accepted accounting principles in the United States, or U.S. GAAP.

Unless otherwise indicated, U.S. dollar translations of NIS amounts presented in this Annual Report on Form 20-F for the year ended on December 31, 2023 are translated using the rate of NIS 3.627 to $1.00, the exchange rate reported by the Bank of Israel on December 29, 2023, U.S. dollar translations of NIS amounts presented in this Annual Report on Form 20-F for the year ended on December 31, 2022 are translated using the rate of NIS 3.519 to $1.00, the exchange rate reported by the Bank of Israel on December 30, 2022, and U.S. dollar translations of NIS amounts presented in this Annual Report on Form 20-F for the year ended on December 31, 2021 are translated using the rate of NIS 3.11 to $1.00, the exchange rate reported by the Bank of Israel on December 31, 2021.

On January 9, 2023, we effected a change in the ratio of our ADSs to ordinary shares from one (1) ADS representing thirty (30) ordinary shares to a new ratio of one (1) ADS representing three hundred (300) ordinary shares. For ADS holders, the ratio change had the same effect as a one-for-ten reverse ADS split. All ADS and related option and warrant information presented in this Annual Report on Form 20-F have been retroactively adjusted to reflect the reduced number of ADSs and the increase in the ADS price which resulted from this action. Unless otherwise indicated, in this Annual Report on Form 20-F fractional ADSs have been rounded to the nearest whole number.

ii

FORWARD LOOKING STATEMENTS

This Annual Report on Form 20-F contains forward-looking statements, about our expectations, beliefs or intentions regarding, among other things, our product development efforts, business, financial condition, results of operations, strategies or prospects. In addition, from time to time, we or our representatives have made or may make forward-looking statements, orally or in writing. Forward-looking statements can be identified by the use of forward-looking words such as “believe,” “expect,” “intend,” “plan,” “may,” “should” or “anticipate” or their negatives or other variations of these words or other comparable words or by the fact that these statements do not relate strictly to historical or current matters. These forward-looking statements may be included in, but are not limited to, various filings made by us with the U.S. Securities and Exchange Commission, or the SEC, press releases or oral statements made by or with the approval of one of our authorized executive officers. Forward-looking statements relate to anticipated or expected events, activities, trends or results as of the date they are made. Because forward-looking statements relate to matters that have not yet occurred, these statements are inherently subject to risks and uncertainties that could cause our actual results to differ materially from any future results expressed or implied by the forward-looking statements. Many factors could cause our actual activities or results to differ materially from the activities and results anticipated in forward-looking statements, including, but not limited to, the factors summarized below.

This Annual Report on Form 20-F identifies important factors which could cause our actual results to differ materially from those indicated by the forward-looking statements, particularly those set forth under the heading “Risk Factors.” The risk factors included in this Annual Report on Form 20-F are not necessarily all of the important factors that could cause actual results to differ materially from those expressed in any of our forward-looking statements. Given these uncertainties, readers are cautioned not to place undue reliance on such forward-looking statements. Factors that could cause our actual results to differ materially from those expressed or implied in such forward-looking statements include, but are not limited to:

| ● | our history of losses and needs for additional capital to fund our operations and our inability to obtain additional capital on acceptable terms, or at all; |

| ● | uncertainties of cash flows and inability to meet working capital needs; |

| ● | the initiation, timing, progress and results of our preclinical studies, clinical trials and other product candidate development efforts; |

| ● | our ability to advance our product candidates into clinical trials or to successfully complete our preclinical studies or clinical trials; |

| ● | our receipt of regulatory approvals for our product candidates, and the timing of other regulatory filings and approvals; |

| ● | the clinical development, commercialization and market acceptance of our product candidates; |

| ● | our ability to establish and maintain strategic partnerships and other corporate collaborations; |

| ● | the implementation of our business model and strategic plans for our business and product candidates; |

| ● | the scope of protection we are able to establish and maintain for intellectual property rights covering our product candidates and our ability to operate our business without infringing the intellectual property rights of others; |

| ● | competitive companies, technologies and our industry; |

| ● | risks related to the resurgence of the COVID-19 pandemic and the Russian invasion of Ukraine; |

| ● | risks related to not satisfying the continued listing requirements of NYSE American; |

| ● | statements as to the impact of the political, economic and security situation in Israel on our business, including due to the current war between Israel and Hamas; and |

| ● | those factors referred to in “Item 3.D. Risk Factors,” “Item 4. Information on the Company,” and “Item 5. Operating and Financial Review and Prospects”, as well as in this annual report on Form 20-F generally. |

All forward-looking statements attributable to us or persons acting on our behalf speak only as of the date of this Annual Report on Form 20-F and are expressly qualified in their entirety by the cautionary statements included in this Annual Report on Form 20-F. We undertake no obligations to update or revise forward-looking statements to reflect events or circumstances that arise after the date made or to reflect the occurrence of unanticipated events. In evaluating forward-looking statements, you should consider these risks and uncertainties.

iii

EXPLANATORY NOTE

Market data and certain industry data and forecasts used throughout this Annual Report on Form 20-F were obtained from sources we believe to be reliable, including market research databases, publicly available information, reports of governmental agencies and industry publications and surveys. We have relied on certain data from third-party sources, including internal surveys, industry forecasts and market research, which we believe to be reliable based on our management’s knowledge of the industry. Forecasts are particularly likely to be inaccurate, especially over long periods of time. In addition, we do not necessarily know what assumptions regarding general economic growth were used in preparing the third-party forecasts we cite. Statements as to our market position are based on the most currently available data. While we are not aware of any misstatements regarding the industry data presented in this Annual Report on Form 20-F, our estimates involve risks and uncertainties and are subject to change based on various factors, including those discussed under the heading “Risk Factors” in this Annual Report on Form 20-F.

iv

PART I

ITEM 1. Identity of Directors, Senior Management and Advisers.

Not applicable.

ITEM 2. Offer Statistics and Expected Timetable.

Not applicable.

ITEM 3. Key Information.

A. [Reserved]

B. Capitalization and Indebtedness.

Not applicable.

C. Reasons for the Offer and Use of Proceeds.

Not applicable.

D. Risk Factors

You should carefully consider the risks we describe below, in addition to the other information set forth elsewhere in this Annual Report on Form 20-F, including our consolidated financial statements and the related notes beginning on page F-1, before deciding to invest in our ordinary shares and American Depositary Shares, or ADSs. These material risks could adversely impact our results of operations, possibly causing the trading price of our ordinary shares and ADSs to decline, and you could lose all or part of your investment.

Summary Risk Factors

The principal factors and uncertainties that make investing in our ordinary shares risky, include, among others:

Risks Related to Our Financial Position and Capital Requirements

| ● | We have incurred operating losses since our inception and anticipate that we will continue to incur substantial operating losses for the foreseeable future. |

| ● | We will need to raise additional capital to meet our business requirements in the future, and such capital raising may be costly or difficult to obtain and will dilute current shareholders’ ownership interests. |

1

Risks Related to Our Business and Regulatory Matters

| ● | We have not yet commercialized any products or technologies, and we may never become profitable. |

| ● | Our product candidates are at various stages of clinical and preclinical development and may never be commercialized. |

| ● | Results of earlier clinical trials may not be predictive of the results of later-stage clinical trials. |

| ● | We might be unable to develop product candidates that will achieve commercial success in a timely and cost-effective manner, or ever. |

| ● | Our current pipeline is based on our platform technology utilizing the Gi protein associated A3AR, as a potent therapeutic target and currently includes three molecules, Piclidenoson, Namodenoson and CF602 product candidates, of which Piclidenoson is the most advanced. Failure to develop these molecules will have a material adverse effect on us. |

| ● | Clinical trials are very expensive, time-consuming and difficult to design and implement, and, as a result, we may suffer delays or suspensions in future trials which would have a material adverse effect on our ability to generate revenues. |

| ● | The manufacture of our product candidates is a chemical synthesis process and if one of our materials suppliers encounters problems manufacturing our products, our business could suffer. |

| ● | We do not currently have sales, marketing or distribution capabilities or experience, and we are unable to effectively sell, market or distribute our product candidates now and we do not expect to be able to do so in the future. The failure to enter into agreements with third parties that are capable of performing these functions would have a material adverse effect on our business and results of operations. |

| ● | We depend on key members of our management and key consultants and will need to add and retain additional leading experts. Failure to retain our management and consulting team and add additional leading experts could have a material adverse effect on our business, results of operations or financial condition. |

| ● | Our product candidates will remain subject to ongoing regulatory requirements even if they receive marketing approval, and if we fail to comply with these requirements, we could lose these approvals, and the sales of any approved commercial products could be suspended. |

| ● | We may not be able to successfully grow and expand our business. Failure to manage our growth effectively will have a material adverse effect on our business, results of operations and financial condition. |

| ● | Our cannabinoid initiative is uncertain and may not yield commercial results and is subject to significant regulatory risks. |

| ● | We or the third parties upon whom we depend may be adversely affected by natural disasters and/or health epidemics, and our business continuity and disaster recovery plans may not adequately protect us from a serious disaster. |

2

Risks Related to Our Intellectual Property

| ● | The expiry of a patent that we licensed from the National Institute of Health, or NIH, and the consequent loss of composition of matter exclusivity that we had by virtue of this license may diminish our proprietary position. |

| ● | We license from Leiden University intellectual property, which protects certain small molecules which target the A3AR, in furtherance of our platform technology, and we could lose our rights to this license if a dispute with Leiden University arises or if we fail to comply with the financial and other terms of the license. |

| ● | The failure to obtain or maintain patents, licensing agreements, including our current licensing agreements, and other intellectual property could impact our ability to compete effectively. |

| ● | International patent protection is particularly uncertain, and if we are involved in opposition proceedings in foreign countries, we may have to expend substantial sums and management resources. |

| ● | We may be unable to protect the intellectual property rights of the third parties from whom we license certain of our intellectual property or with whom we have entered into other strategic relationships. |

| ● | Under applicable U.S. and Israeli law, we may not be able to enforce covenants not to compete and therefore, may be unable to prevent our competitors from benefiting from the expertise of some of our former employees. In addition, employees may be entitled to seek compensation for their inventions irrespective of their agreements with us, which in turn could impact our future profitability. |

| ● | We may be subject to claims challenging the inventorship of our patents and other intellectual property. |

Risks Related to Our Industry

| ● | We expect the healthcare industry to face increased limitations on reimbursement as a result of healthcare reform, which could adversely affect third-party coverage of our products and how much or under what circumstances healthcare providers will prescribe or administer our products. |

| ● | Our employees, principal investigators, consultants, commercial partners or vendors may engage in misconduct or other improper activities, including non-compliance with regulatory standards. |

Risks Related to Our Operations in Israel

| ● | We conduct our operations in Israel and therefore our results may be adversely affected by political, economic and military instability in Israel and its region. |

| ● | Because a certain portion of our expenses is incurred in currencies other than U.S. dollars, our results of operations may be harmed by currency fluctuations and inflation. |

Risks Related to Our Ordinary Shares and ADSs

| ● | Our business, operating results and growth rates may be adversely affected by current or future unfavorable economic and market conditions and adverse developments with respect to financial institutions and associated liquidity risk. |

| ● | Our business could be negatively impacted by unsolicited takeover proposals, by shareholder activism or by proxy contests relating to the election of directors or other matters. |

3

| ● | Issuance of additional equity securities may adversely affect the market price of our ADSs or ordinary shares. |

| ● | The market price of our ordinary shares and ADSs is subject to fluctuation, which could result in substantial losses by our investors. |

| ● | We may not satisfy the NYSE American requirements for continued listing. If we cannot satisfy these requirements, the NYSE American could delist our securities. |

| ● | As a foreign private issuer, we are permitted to follow certain home country corporate governance practices instead of applicable SEC and NYSE American requirements, which may result in less protection than is accorded to investors under rules applicable to domestic issuers. |

Risks Related to Our Financial Position and Capital Requirements

We have incurred operating losses since our inception and anticipate that we will continue to incur substantial operating losses for the foreseeable future.

We are a clinical-stage biopharmaceutical company that develops orally bioavailable small molecule therapeutic products for the treatment of cancer, liver and inflammatory diseases and erectile dysfunction. Since our incorporation in 1994, we have been focused on research and development activities with a view to developing our product candidates, CF101, also known as Piclidenoson, CF102, also known as Namodenoson, and CF602. We have financed our operations primarily through the sale of equity securities (both in private placements and in public offerings on the TASE and NYSE American) and payments received under out-licensing agreements and have incurred losses in each year since our inception in 1994. We have historically incurred substantial net losses, including net losses of approximately $7.6 million in 2023, $10.1 million in 2022, and $12.6 million in 2021. As of December 31, 2023, we had an accumulated deficit of approximately $158.5 million. We do not know whether or when we will become profitable. To date, we have not commercialized any products or generated any revenues from product sales and accordingly we do not have a revenue stream to support our cost structure. Our losses have resulted principally from costs incurred in development and discovery activities. We expect to continue to incur losses for the foreseeable future, and these losses will likely increase as we:

| ● | initiate and manage pre-clinical development and clinical trials for our current and new product candidates; |

| ● | seek regulatory approvals for our product candidates; |

| ● | implement internal systems and infrastructures; |

| ● | seek to license additional technologies to develop; |

| ● | hire management and other personnel; and |

| ● | move towards commercialization. |

If our product candidates fail in clinical trials or do not gain regulatory clearance or approval, or if our product candidates do not achieve market acceptance, we may never become profitable. Even if we do achieve profitability, we may not be able to sustain or increase profitability on a quarterly or annual basis. Our inability to achieve and then maintain profitability would negatively affect our business, financial condition, results of operations and cash flows. Moreover, our prospects must be considered in light of the risks and uncertainties encountered by an early-stage company and in highly regulated and competitive markets, such as the biopharmaceutical market, where regulatory approval and market acceptance of our products are uncertain. There can be no assurance that our efforts will ultimately be successful or result in revenues or profits.

4

We will need to raise additional capital to meet our business requirements in the future, and such capital raising may be costly or difficult to obtain and will dilute current shareholders’ ownership interests.

As of December 31, 2023, we had cash and cash equivalents of $4.3 million and short-term deposits of $4.6 million. In January 2023, we raised approximately $7.5 million in gross proceeds (approximately $6.5 million net of issuance costs) from a registered direct offering and a concurrent private placement and subsequently in November 2023, we raised approximately $3.0 million in gross proceeds (approximately $2.61 million net of issuance costs) from a warrant repricing and exercise transaction. We believe that our existing financial resources will be sufficient to meet our requirements for the next twelve months from the date of issuance of this Annual Report on Form 20-F. We have expended and believe that we will continue to expend substantial resources for the foreseeable future developing our product candidates. These expenditures will include costs associated with research and development, manufacturing, conducting preclinical experiments and clinical trials and obtaining regulatory approvals, as well as commercializing any products approved for sale. Because the outcome of our planned and anticipated clinical trials is highly uncertain, we cannot reasonably estimate the actual amounts necessary to successfully complete the development and commercialization of our product candidates. In addition, other unanticipated costs may arise. As a result of these and other factors currently unknown to us, we will require additional funds, through public or private equity or debt financings or other sources, such as strategic partnerships and alliances and licensing arrangements. In addition, we may seek additional capital due to favorable market conditions or strategic considerations even if we believe we have sufficient funds for our current or future operating plans.

Our future capital requirements will depend on many factors, including the progress and results of our clinical trials, the duration and cost of discovery and preclinical development, and laboratory testing and clinical trials for our product candidates, the timing and outcome of regulatory review of our product candidates, the number and development requirements of other product candidates that we pursue, and the costs of activities, such as product marketing, sales, and distribution. Because of the numerous risks and uncertainties associated with the development and commercialization of our product candidates, we are unable to estimate the amounts of increased capital outlays and operating expenditures associated with our anticipated clinical trials.

Our future capital requirements depend on many factors, including:

| ● | the level of research and development investment required to develop our product candidates; |

| ● | the failure to obtain regulatory approval or achieve commercial success of our product candidates, including Piclidenoson, Namodenoson and CF602; |

| ● | the results of our preclinical studies and clinical trials for our earlier stage product candidates, and any decisions to initiate clinical trials if supported by the preclinical results; |

| ● | the costs, timing and outcome of regulatory review of our product candidates that progress to clinical trials; |

| ● | our ability to partner or sub-license any of our product candidates; |

| ● | the costs of preparing, filing and prosecuting patent applications, maintaining and enforcing our issued patents and defending intellectual property-related claims; |

| ● | the cost of commercialization activities if any of our product candidates are approved for sale, including marketing, sales and distribution costs; |

| ● | the cost of manufacturing our product candidates and any products we successfully commercialize; |

| ● | the timing, receipt and amount of sales of, or royalties on, our future products, if any; |

| ● | the expenses needed to attract and retain skilled personnel; |

| ● | any product liability or other lawsuits related to our products; |

5

| ● | the extent to which we acquire or invest in businesses, products or technologies and other strategic relationships; |

| ● | the costs of financing unanticipated working capital requirements and responding to competitive pressures; and |

| ● | maintaining minimum shareholders’ equity requirements and complying with other continue listing standards under the NYSE American Company Guide |

Additional funds may not be available when we need them, on terms that are acceptable to us, or at all. General market conditions may make it very difficult for us to seek financing from the capital markets and the Russian invasion of Ukraine and the current war between Israel and Hamas could impact the availability or cost of future financings. If adequate funds are not available to us on a timely basis, we may be required to delay, limit, reduce or terminate preclinical studies, clinical trials or other research and development activities for one or more of our product candidates or delay, limit, reduce or terminate our establishment of sales and marketing capabilities or other activities that may be necessary to commercialize our product candidates.

We may incur substantial costs in pursuing future capital financing, including investment banking fees, legal fees, accounting fees, securities law compliance fees, printing and distribution expenses and other costs. We may also be required to recognize non-cash expenses in connection with certain securities we issue, such as convertible notes and warrants, which may adversely impact our financial condition.

Raising additional capital may cause dilution to our existing stockholders, restrict our operations or require us to relinquish rights to our technologies or product candidates.

We may seek additional capital through a combination of private and public equity offerings, debt financings, strategic partnerships and alliances and licensing arrangements. To the extent that we raise additional capital through the sale of equity or convertible debt securities, the ownership interests of existing shareholders will be diluted, and the terms may include liquidation or other preferences that adversely affect shareholder rights. Debt financing, if available, may involve agreements that include covenants limiting or restricting our ability to take certain actions, such as incurring debt, making capital expenditures or declaring dividends. If we raise additional funds through strategic partnerships and alliances and licensing arrangements with third parties, we may have to relinquish valuable rights to our technologies or product candidates, or grant licenses on terms that are not favorable to us. If we are unable to raise additional funds through equity or debt financing when needed, we may be required to delay, limit, reduce or terminate our product development or commercialization efforts or grant rights to develop and market product candidates that we would otherwise prefer to develop and market ourselves.

Risks Related to Our Business and Regulatory Matters

We have not yet commercialized any products or technologies, and we may never become profitable.

We have not yet commercialized any products or technologies, and we may never be able to do so. We do not know when or if we will complete any of our product development efforts, obtain regulatory approval for any product candidates incorporating our technologies or successfully commercialize any approved products. Even if we are successful in developing products that are approved for marketing, we will not be successful unless these products gain market acceptance for appropriate indications at favorable reimbursement rates. The degree of market acceptance of these products will depend on a number of factors, including:

| ● | the timing of regulatory approvals in the countries, and for the uses, we seek; |

| ● | the competitive environment; |

| ● | the establishment and demonstration in the medical community of the safety and clinical efficacy of our products and their potential advantages over existing therapeutic products; |

6

| ● | our ability to enter into distribution and other strategic agreements with pharmaceutical and biotechnology companies with strong marketing and sales capabilities; |

| ● | the adequacy and success of distribution, sales and marketing efforts; and |

| ● | the pricing and reimbursement policies of government and third-party payors, such as insurance companies, health maintenance organizations and other plan administrators. |

Physicians, patients, thirty-party payors or the medical community in general may be unwilling to accept, utilize or recommend, and in the case of third-party payors, cover any of our products or products incorporating our technologies. As a result, we are unable to predict the extent of future losses or the time required to achieve profitability, if at all. Even if we successfully develop one or more products that incorporate our technologies, we may not become profitable.

Our product candidates are at various stages of clinical and preclinical development and may never be commercialized.

Our product candidates are at various stages of clinical development and may never be commercialized. The progress and results of any future pre-clinical testing or future clinical trials are uncertain, and the failure of our product candidates to receive regulatory approvals will have a material adverse effect on our business, operating results and financial condition to the extent we are unable to commercialize any products. None of our product candidates has received regulatory approval for commercial sale. In addition, we face the risks of failure inherent in developing therapeutic products. Our product candidates are not expected to be commercially available for several years, if at all.

In order to receive U.S. Food and Drug Administration, or FDA, approval or approval from foreign regulatory authorities to market a product candidate or to distribute our products, we must demonstrate thorough pre-clinical testing and thorough human clinical trials that the product candidate is safe and effective for its intended uses (e.g., treatment of a specific condition in a specific way subject to contraindications and other limitations). If the FDA, or foreign regulatory authorities, determine that data from our pre-clinical testing and clinical trials are not sufficient to support approval, the FDA, or foreign regulatory authorities, may require additional pre-clinical testing or clinical trials for our product candidates. Even if we comply with all FDA requests, the FDA may ultimately reject one or more of our New Drug Applications, or NDA, or grant approval for a narrowly intended use that is not commercially feasible. We might not obtain regulatory approval for our drug candidates in a timely manner, if at all. Failure to obtain FDA approval of any of our drug candidates in a timely manner or at all will severely undermine our business by reducing the number of salable products and, therefore, corresponding product revenues.

Results of earlier clinical trials may not be predictive of the results of later-stage clinical trials.

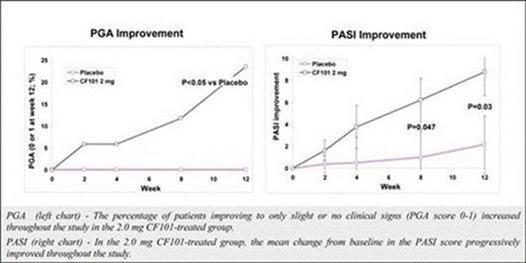

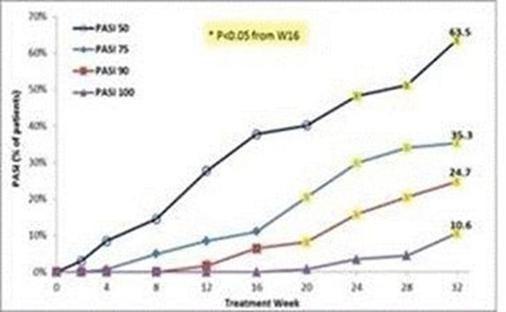

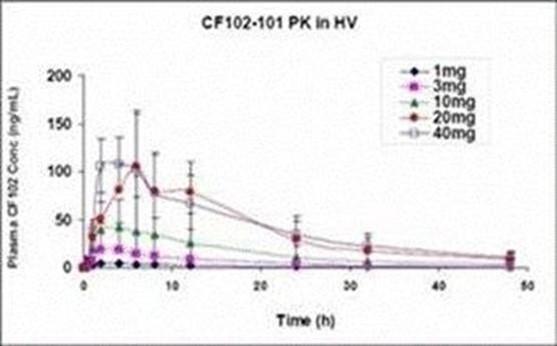

The results of preclinical studies and early clinical trials of product candidates may not be predictive of the results of later-stage clinical trials. Also, interim results, if at all, during a clinical trial do not necessarily predict final results. Product candidates in later stages of clinical trials may fail to show the desired safety and efficacy results despite having progressed through preclinical studies and initial clinical trials. For example, our former subsidiary OphthaliX Inc, or OphthaliX, announced top-line results of a Phase III study with Piclidenoson for dry-eye syndrome in which Piclidenoson did not meet the primary efficacy endpoint of complete clearing of corneal staining, nor the secondary efficacy endpoints, OphthaliX released top-line results from its Phase II clinical trial of Piclidenoson for the treatment of glaucoma in which no statistically significant differences were found between the Piclidenoson treated group and the placebo group in the primary endpoint of lowering intraocular pressure, or IOP. In addition, two Phase IIb studies in rheumatoid arthritis, utilizing Piclidenoson in combination with methotrexate, a generic drug commonly used for treating rheumatoid arthritis patients, or MTX, failed to reach their primary endpoints and we ended our Phase III ACROBAT study after the independent data monitoring committee, or IDMC recommended in a pre-planned interim analysis not to continue this study. A Phase II/III study of Piclidenoson for psoriasis did not meet its primary endpoint although positive data from further analysis of the Phase II/III study suggests Piclidenoson as a potential systemic therapy for patients with moderate-severe psoriasis. Furthermore, a Phase II study for advanced HCC in subjects with Child-Pugh B who failed Nexavar as a first line treatment did not meet its primary endpoint although it showed superiority in overall survival in the largest study subpopulation.

7

Many companies in the pharmaceutical industry have suffered significant setbacks in advanced clinical trials due to adverse safety profiles or lack of efficacy, notwithstanding promising results in earlier studies. Any delay in, or termination or suspension of, our clinical trials will delay the requisite filings with the FDA, the EMA or other foreign regulatory authorities and, ultimately, our ability to commercialize our product candidates and generate product revenues. If the clinical trials do not support our product claims, the completion of development of such product candidates may be significantly delayed or abandoned, which will significantly impair our ability to generate product revenues and will materially adversely affect our results of operations.

This drug candidate development risk is heightened by any changes in the planned clinical trials compared to the completed clinical trials. As product candidates are developed from preclinical through early to late stage clinical trials towards approval and commercialization, it is customary that various aspects of the development program, such as manufacturing and methods of administration, are altered along the way in an effort to optimize processes and results. While these types of changes are common and are intended to optimize the product candidates for late stage clinical trials, approval and commercialization, such changes do carry the risk that they will not achieve these intended objectives.

Changes in our planned clinical trials or future clinical trials could cause our product candidates to perform differently, including causing toxicities, which could delay completion of our clinical trials, delay approval, if any, of our product candidates, and/or jeopardize our ability to commence product sales and generate revenues.

We might be unable to develop product candidates that will achieve commercial success in a timely and cost-effective manner, or ever.

Even if regulatory authorities approve our product candidates, they may not be commercially successful. Our product candidates may not be commercially successful because government agencies and other third-party payors may not cover the product or the coverage may be too limited to be commercially successful; physicians and others may not use or recommend our products, even following regulatory approval. A product approval, assuming one issues, may limit the uses for which the product may be distributed thereby adversely affecting the commercial viability of the product. Third parties may develop superior products or have proprietary rights that preclude us from marketing our products. We also expect that at least some of our product candidates will be expensive, if approved. Patient acceptance of and demand for any product candidates for which we obtain regulatory approval or license will depend largely on many factors, including but not limited to the extent, if any, of reimbursement of costs by government agencies and other third-party payors, pricing, the effectiveness of our marketing and distribution efforts, the safety and effectiveness of alternative products, and the prevalence and severity of side effects associated with our products. If physicians, government agencies and other third-party payors do not accept our products, we will not be able to generate significant revenue. In addition, government regulators and legislative bodies in the U.S. are considering numerous proposals that may result in limitations on the prices at which we could charge customers for our products if we have products that are ultimately approved for sale. At this time, we are unable to predict how these potential legislative changes might affect our business.

Our current pipeline is based on our platform technology utilizing the Gi protein associated A3AR, as a potent therapeutic target and currently includes three molecules, Piclidenoson, Namodenoson and CF602 product candidates, of which Piclidenoson is the most advanced. Failure to develop these molecules will have a material adverse effect on us.

Our current pipeline is based on a platform technology where we target the A3AR with highly selective ligands, or small signal triggering molecules that bind to specific cell surface receptors, such as the A3AR, including Piclidenoson, Namodenoson and CF602. A3ARs are structures found in cell surfaces that record and transfer messages from small molecules or ligands, such as Piclidenoson, Namodenoson and CF602 to the rest of the cell. Piclidenoson is the most advanced of our drug candidates. As such, we are currently dependent on only three molecules for our potential commercial success, and any safety or efficacy concerns related to such molecules would have a significant impact on our business. Failure to develop our drug candidates, in whole or in part, will have a material adverse effect on us.

8

Clinical trials are very expensive, time-consuming and difficult to design and implement, and, as a result, we may suffer delays or suspensions in future trials which would have a material adverse effect on our ability to generate revenues.

Human clinical trials are very expensive and difficult to design and implement, in part because they are subject to rigorous regulatory requirements. Regulatory authorities, such as the FDA, may preclude or prohibit clinical trials from proceeding. Additionally, the clinical trial process is time-consuming, failure can occur at any stage of the trials, and we may encounter problems that cause us to abandon or repeat clinical trials. The commencement and completion of clinical trials may be delayed by several factors, including:

| ● | unforeseen safety issues; |

| ● | non-acceptance of an IND by the FDA; |

| ● | determination of dosing issues; |

| ● | lack of effectiveness or efficacy during clinical trials; |

| ● | inability to manufacture sufficient quantities of drug candidate; |

| ● | changes in formulation or manufacturing changes; |

| ● | failure of third-party suppliers to perform final manufacturing steps for the drug substance; |

| ● | slower than expected rates of patient recruitment and enrollment; |

| ● | inability to retain patients in clinical trials; |

| ● | lack of healthy volunteers and patients to conduct trials; |

| ● | inability to monitor patients adequately during or after treatment; |

| ● | failure to reach an agreement with contract research organizations or clinical trial sites; |

| ● | failure of institutional review boards, or IRBs, to approve our clinical trial protocols or suspension or termination of our clinical trial by the IRB, DSMB, or the FDA; |

| ● | failure of institutional review boards to approve our clinical trial protocols; |

| ● | inability or unwillingness of clinical investigators and institutional review boards to follow our clinical trial protocols; |

| ● | failure of clinical investigators or sites to maintain necessary licenses or permits or comply with good clinical practices, or GCP, or other regulatory requirements; |

| ● | debarment of a clinical investigator by FDA or other similar suspension or exclusion by a regulatory authority; and |

| ● | lack of sufficient funding to finance the clinical trials. |

We have experienced the risks involved with conducting clinical trials, including but not limited to, increased expense and delay and failure to meet end points of the trial. For example, OphthaliX, announced top-line results of a Phase III study with Piclidenoson for dry-eye syndrome in which Piclidenoson did not meet the primary efficacy endpoint of complete clearing of corneal staining, nor the secondary efficacy endpoints and OphthaliX released top-line results from its Phase II clinical trial of Piclidenoson for the treatment of glaucoma in which no statistically significant differences were found between the Piclidenoson treated group and the placebo group in the primary endpoint of lowering IOP. In addition, two Phase IIb studies in rheumatoid arthritis, utilizing Piclidenoson in combination with MTX failed to reach their primary end points and we ended our Phase III ACROBAT study after the IDMC recommended in a pre-planned interim analysis not to continue this study. A Phase II/III study of Piclidenoson for psoriasis did not meet its primary endpoint although positive data from further analysis of the Phase II/III study suggests Piclidenoson as a potential systemic therapy for patients with moderate-severe psoriasis. Furthermore, a Phase II study of Namodenoson for advanced HCC in subjects with Child-Pugh B who failed Nexavar as a first line treatment did not meet its primary endpoint although it showed superiority in overall survival in the largest study subpopulation.

9

In addition, we or regulatory authorities may suspend our clinical trials at any time if it appears that we are exposing participants to unacceptable health risks or if the regulatory authorities find deficiencies in our regulatory submissions or the conduct of these trials. Any suspension of clinical trials will delay possible regulatory approval, if any, increase costs, and adversely impact our ability to develop products and generate revenue.

We seek to partner with third-party collaborators with respect to the development and commercialization of Piclidenoson and for any other product candidate, and we may not succeed in establishing and maintaining collaborative relationships, which may significantly limit our ability to develop and commercialize our product candidates successfully, if at all.

Our business strategy relies in part on partnering with pharmaceutical companies to complement our internal development efforts. We will be competing with many other companies as we seek partners for Piclidenoson, Namodenoson and for any other product candidate and we may not be able to compete successfully against those companies. If we are not able to enter into collaboration arrangements for Piclidenoson, Namodenoson and for any other product candidate, we may be required to undertake and fund further development, clinical trials, manufacturing and commercialization activities solely at our own expense and risk. If we are unable to finance and/or successfully execute those expensive activities, or we delay such activities due to capital availability, our business could be materially and adversely affected, and potential future product launch could be materially delayed, be less successful, or we may be forced to discontinue clinical development of these product candidates. The process of establishing and maintaining collaborative relationships is difficult, time-consuming and involves significant uncertainty, including:

| ● | a collaboration partner may shift its priorities and resources away from our product candidates due to a change in business strategies, or a merger, acquisition, sale or downsizing; |

| ● | a collaboration partner may seek to renegotiate or terminate their relationships with us due to unsatisfactory clinical results, manufacturing issues, a change in business strategy, a change of control or other reasons; |

| ● | a collaboration partner may cease development in therapeutic areas which are the subject of our strategic collaboration |

| ● | a collaboration partner may not devote sufficient capital or resources towards our product candidates; |

| ● | a collaboration partner may change the success criteria for a drug candidate thereby delaying or ceasing development of such candidate; |

| ● | a significant delay in initiation of certain development activities by a collaboration partner will also delay payment of milestones tied to such activities, thereby impacting our ability to fund our own activities; |

| ● | a collaboration partner could develop a product that competes, either directly or indirectly, with our drug candidate; |

| ● | a collaboration partner with commercialization obligations may not commit sufficient financial or human resources to the marketing, distribution or sale of a product; |

| ● | a collaboration partner with manufacturing responsibilities may encounter regulatory, resource or quality issues and be unable to meet demand requirements; |

10

| ● | a partner may exercise a contractual right to terminate a strategic alliance; |

| ● | a dispute may arise between us and a partner concerning the research, development or commercialization of a drug candidate resulting in a delay in milestones, royalty payments or termination of an alliance and possibly resulting in costly litigation or arbitration which may divert management attention and resources; and |

| ● | a partner may use our products or technology in such a way as to invite litigation from a third party. |

Any collaborative partners we enter into agreements with in the future may shift their priorities and resources away from our product candidates or seek to renegotiate or terminate their relationships with us. If any collaborator fails to fulfill its responsibilities in a timely manner, or at all, our research, clinical development, manufacturing or commercialization efforts related to that collaboration could be delayed or terminated, or it may be necessary for us to assume responsibility for expenses or activities that would otherwise have been the responsibility of our collaborator. If we are unable to establish and maintain collaborative relationships on acceptable terms or to successfully transition terminated collaborative agreements, we may have to delay or discontinue further development of one or more of our product candidates, undertake development and commercialization activities at our own expense or find alternative sources of capital.

If we acquire or license additional technology or product candidates, we may incur a number of costs, may have integration difficulties and may experience other risks that could harm our business and results of operations.

We may acquire and license additional product candidates and technologies. Any product candidate or technology we license from others or acquire will likely require additional development efforts prior to commercial sale, including extensive pre-clinical or clinical testing, or both, and approval by the FDA and applicable foreign regulatory authorities, if any. All product candidates are prone to risks of failure inherent in pharmaceutical product development, including the possibility that the product candidate or product developed based on licensed technology will not be shown to be sufficiently safe and effective for approval by regulatory authorities. In addition, we cannot assure you that any product candidate that we develop based on acquired or licensed technology that is granted regulatory approval will be manufactured or produced economically, successfully commercialized or widely accepted in the marketplace. Moreover, integrating any newly acquired product candidates could be expensive and time-consuming. If we cannot effectively manage these aspects of our business strategy, our business may not succeed.

The manufacture of our product candidates is a chemical synthesis process and if one of our materials suppliers encounters problems manufacturing our products, our business could suffer.

The FDA and foreign regulators require manufacturers to register manufacturing facilities. The FDA and foreign regulators also inspect these facilities to confirm compliance with requirements that the FDA or foreign regulators establish. We do not intend to engage in the manufacture of our products other than for pre-clinical and clinical studies, but we or our materials suppliers may face manufacturing or quality control problems causing product production and shipment delays or a situation where we or the supplier may not be able to maintain compliance with the FDA’s or foreign regulators’ requirements necessary to continue manufacturing our drug substance. Drug manufacturers are subject to ongoing periodic unannounced inspections by the FDA, the U.S. Drug Enforcement Agency, or DEA, and corresponding foreign regulators to ensure strict compliance with requirements and other governmental regulations and corresponding foreign standards. Any failure to comply with DEA requirements or FDA or foreign regulatory requirements could adversely affect our clinical research activities and our ability to develop our product candidates, and delay possible regulatory approval.

We do not currently have sales, marketing or distribution capabilities or experience, and we are unable to effectively sell, market or distribute our product candidates now and we do not expect to be able to do so in the future. The failure to enter into agreements with third parties that are capable of performing these functions would have a material adverse effect on our business and results of operations.

We do not currently have, and we do not expect to develop, sales, marketing and distribution capabilities. If we are unable to enter into agreements with third parties to perform these functions, we will not be able to successfully market any of our platforms or product candidates. In order to successfully market any of our platform or product candidates, we must make arrangements with third parties to perform these services.

11

As we do not intend to develop a marketing and sales force with technical expertise and supporting distribution capabilities, we will be unable to market any of our product candidates directly. To promote any of our potential products through third parties, we will have to locate acceptable third parties for these functions and enter into agreements with them on acceptable terms, and we may not be able to do so. Any third-party arrangements we are able to enter into may result in lower revenues than we could achieve by directly marketing and selling our potential products. In addition, to the extent that we depend on third parties for marketing and distribution, any revenues we receive will depend upon the efforts of such third parties, as well as the terms of our agreements with such third parties, which cannot be predicted in most cases at this time. As a result, we might not be able to market and sell our products in the United States or overseas, which would have a material adverse effect on us.

We will to some extent rely on third parties to implement our manufacturing and supply strategies. Failure of these third parties in any respect could have a material adverse effect on our business, results of operations and financial condition.

If our current and future manufacturing and supply strategies are unsuccessful, then we may be unable to conduct and complete any future pre-clinical or clinical trials or commercialize our product candidates in a timely manner, if at all. Completion of any potential future pre-clinical or clinical trials and commercialization of our product candidates will require access to, or development of, facilities to manufacture a sufficient supply of our product candidates. We do not have the resources, facilities or experience to manufacture our product candidates for commercial purposes on our own and do not intend to develop or acquire facilities for the manufacture of product candidates for commercial purposes in the foreseeable future. We may rely on contract manufacturers to produce sufficient quantities of our product candidates necessary for any pre-clinical or clinical testing we undertake in the future. Such contract manufacturers may be the sole source of production and they may have limited experience at manufacturing, formulating, analyzing, filling and finishing our types of product candidates.

We also intend to rely on third parties to supply the requisite materials needed for the manufacturing of our active pharmaceutical ingredients, or API. There may be a limited supply of these requisite materials. We might not be able to enter into agreements that provide us assurance of availability of such components in the future from any supplier. Our potential suppliers may not be able to adequately supply us with the components necessary to successfully conduct our pre-clinical and clinical trials or to commercialize our product candidates. In particular, the any resurgence of COVID-19 globally could result in the inability of our suppliers to deliver components or raw materials on a timely basis or at all. If we cannot acquire an acceptable supply of the requisite materials to produce our product candidates, we will not be able to complete pre-clinical and clinical trials delaying possible regulatory approval, and adversely impacting our ability to develop products, and will not be able to market or commercialize our product candidates, if approved.

We depend on key members of our management and key consultants and will need to add and retain additional leading experts. Failure to retain our management and consulting team and add additional leading experts could have a material adverse effect on our business, results of operations or financial condition.

We are highly dependent on our executive officers and other key management and technical personnel. Our failure to retain our Executive Chairman and Chief Scientific Officer, Pnina Fishman, Ph.D., who has developed much of the technology we utilize today, or any other key management and technical personnel, could have a material adverse effect on our future operations. Our success is also dependent on our ability to attract, retain and motivate highly trained technical, and management personnel, among others, to continue the development and commercialization, if approved, of our current and future product candidates.

Our success also depends on our ability to attract, retain and motivate personnel required for the development, maintenance and expansion of our activities. There can be no assurance that we will be able to retain our existing personnel or attract additional qualified employees or consultants. The loss of key personnel or the inability to hire and retain additional qualified personnel in the future could have a material adverse effect on our business, financial condition and results of operation.

12

We face significant competition and continuous technological change, and developments by competitors may render our products or technologies obsolete or non-competitive. If we cannot successfully compete with new or existing products, our marketing and sales will suffer and we may not ever be profitable.

We will compete against fully integrated pharmaceutical and biotechnology companies and smaller companies that are collaborating with larger pharmaceutical companies, academic institutions, government agencies and other public and private research organizations. In addition, many of these competitors, either alone or together with their collaborative partners, operate larger research and development programs than we do, and have substantially greater financial resources than we do, as well as significantly greater experience in:

| ● | developing drugs; |

| ● | undertaking pre-clinical testing and human clinical trials; |

| ● | obtaining FDA approval, addressing various regulatory matters and other regulatory approvals of drugs; |

| ● | formulating and manufacturing drugs; and |

| ● | launching, marketing and selling drugs. |

If our competitors develop and commercialize products faster than we do, or develop and commercialize products that are superior to our product candidates, our commercial opportunities will be reduced or eliminated. The extent to which any of our product candidates achieve market acceptance will depend on competitive factors, many of which are beyond our control. Competition in the biotechnology and biopharmaceutical industry is intense and has been accentuated by the rapid pace of technology development. Our competitors include large integrated pharmaceutical companies, biotechnology companies that currently have drug and target discovery efforts, universities, and public and private research institutions. Almost all of these entities have substantially greater research and development capabilities and financial, scientific, manufacturing, marketing and sales resources than we do. These organizations also compete with us to:

| ● | attract parties for acquisitions, joint ventures or other collaborations; |

| ● | license proprietary technology that is competitive with the technology we are developing; |

| ● | attract funding; and |

| ● | attract and hire scientific talent and other qualified personnel. |

Our competitors may succeed in developing and commercializing products earlier and obtaining regulatory approvals from the FDA or foreign regulators more rapidly than we do. Our competitors may also develop products or technologies that are superior to those we are developing, and render our product candidates or technologies obsolete or non-competitive. If we cannot successfully compete with new or existing products, our marketing and sales will suffer and we may not ever be profitable.

Our competitors currently include companies with marketed products and/or an advanced research and development pipeline. The major competitors in the psoriasis therapeutic field include Amgen, J&J, Pfizer, Novartis, Abbvie, Eli Lilly, Bristol-Myers Squibb, UCB and more. Competitors in the HCC field include companies such as Bayer, Exelixis, Merck, Roche, Eisai, Astrazenca, Beigene, Novartis, and Bristol-Myers Squibb. Competitors in the nonalcoholic steatohepatisi, or NASH, field (also known as metabolic dysfunction-associated steatohepatitis, or MASH)) include companies such as Gilead, Genfit, Galmed, Madrigal, Akero, 89Bio, Viking, and Terns. Competitors in the erectile dysfunction field include Pfizer, Eli Lilly, Bayer, and Petros Pharmaceuticals. See “Item 4. Information on the Company—B. Business Overview—Competition.”

13

Moreover, several companies have reported the commencement of research projects related to the A3AR. Such companies include CV Therapeutics Inc. (which was acquired by Gilead), King Pharmaceuticals R&D Inv. (which was acquired by Pfizer), Hoechst Marion Roussel Inc. (which was acquired by Aventis), Novo Nordisk A/S and Inotek Pharmaceuticals. However, to the best of our knowledge, there is no approved drug currently on the market, which is similar to our A3AR agonists, nor are we aware of any allosteric modulator in the A3AR product pipeline similar to our allosteric modulator with respect to chemical profile and mechanism of action.

We may suffer losses from product liability claims if our product candidates cause harm to patients.

Any of our product candidates could cause adverse events. Although a pooled safety analysis from clinical trials encompassing more than 1,600 humans dosed with Piclidenoson through the completion of our Phase II rheumatoid arthritis and psoriasis trials indicated that Piclidenoson is generally well-tolerated at doses up to 4.0 mg administered twice daily for up to 12-48 weeks, there were incidences (less than or equal to 5%) of adverse events in eight completed and fully analyzed trials in inflammatory disease. Such adverse events included nausea, diarrhea, abdominal pain, vomiting, constipation, common bacterial and viral syndromes (such as tonsillitis, otitis and respiratory and urinary tract infections), abdominal pain, vomiting, myalgia, arthralgia, dizziness, headache and pruritus. We observed an even lower incidence (less than or equal to 2%) of serious adverse events, although only one type of event was reported in more than a single Piclidenoson-treated subject, which was exacerbation of chronic obstructive lung disease reported in two subjects. Notwithstanding the foregoing, the placebo group in such studies had a higher incidence of overall adverse events than the pooled Piclidenoson groups. In addition, in normal volunteers, Piclidenoson at doses 3-4-fold higher than those to be used in therapeutic trials, but not at therapeutic doses, was associated with prolongation of the electrocardiographic QT intervals. No new safety concerns have been identified and no novel or unexpected safety concerns have appeared over 48 weeks of treatment in more recent trials.

There is also a risk that certain adverse events may not be observed in clinical trials, but may nonetheless occur in the future. If any of these adverse events occur, they may render our product candidates ineffective or harmful in some patients, and our sales would suffer, materially adversely affecting our business, financial condition and results of operations.

In addition, potential adverse events caused by our product candidates could lead to product liability lawsuits. If product liability lawsuits are successfully brought against us, we may incur substantial liabilities and may be required to limit the marketing and commercialization of our product candidates. Our business exposes us to potential product liability risks, which are inherent in the testing, manufacturing, marketing and sale of pharmaceutical products. We may not be able to avoid product liability claims. Product liability insurance for the pharmaceutical and biotechnology industries is generally expensive, if available at all. If, at any time, we are unable to obtain sufficient insurance coverage on reasonable terms or to otherwise protect against potential product liability claims, we may be unable to clinically test, market or commercialize our product candidates. A successful product liability claim brought against us in excess of our insurance coverage, if any, may cause us to incur substantial liabilities, and, as a result, our business, liquidity and results of operations would be materially adversely affected.

Our product candidates will remain subject to ongoing regulatory requirements even if they receive marketing approval, and if we fail to comply with these requirements, we could lose these approvals, and the sales of any approved commercial products could be suspended.

Even if we receive regulatory approval to market a particular product candidate, the product will remain subject to extensive regulatory requirements, including requirements relating to manufacturing, labelling, packaging, adverse event reporting, storage, advertising, promotion, distribution and recordkeeping. Even if regulatory approval of a product is granted, the approval may be subject to limitations on the uses for which the product may be marketed or the conditions of approval, or may contain requirements for costly post-marketing testing and surveillance to monitor the safety or efficacy of the product, which could negatively impact us or our collaboration partners by reducing revenues or increasing expenses, and cause the approved product candidate not to be commercially viable. In addition, as clinical experience with a drug expands after approval, typically because it is used by a greater number and more diverse group of patients after approval than during clinical trials, side effects and other problems may be observed after approval that were not seen or anticipated during pre-approval clinical trials or other studies. Any adverse effects observed after the approval and marketing of a product candidate could result in limitations on the use of or withdrawal of any approved products from the marketplace. Absence of long-term safety data may also limit the approved uses of our products, if any. If we fail to comply with the regulatory requirements of the FDA and other applicable U.S. and foreign regulatory authorities, or previously unknown problems with any approved commercial products, manufacturers or manufacturing processes are discovered, we could be subject to administrative or judicially imposed sanctions or other setbacks, including the following:

| ● | Restrictions on the products, manufacturers or manufacturing process; |

| ● | Warning or other enforcement letters; |

14

| ● | Civil or criminal penalties, fines and injunctions; |

| ● | Product seizures or detentions; |

| ● | Import or export bans or restrictions; |

| ● | Voluntary or mandatory product recalls and related publicity requirements; |

| ● | Suspension or withdrawal of regulatory approvals; |

| ● | Total or partial suspension of production; and |

| ● | Refusal to approve pending applications for marketing approval of new products or supplements to approved applications. |

If we or our collaborators are slow or unable to adapt to changes in existing regulatory requirements or adoption of new regulatory requirements or policies, marketing approval for our product candidates may be lost or cease to be achievable, resulting in decreased revenue from milestones, product sales or royalties, which would have a material adverse effect on our results of operations.

We deal with hazardous materials and must comply with environmental, health and safety laws and regulations, which can be expensive and restrict how we do business.

Our activities and those of our third-party manufacturers on our behalf involve the controlled storage, use and disposal of hazardous materials, including corrosive, explosive and flammable chemicals and other hazardous compounds. We and our manufacturers are subject to U.S. federal, state, and local, and Israeli and other foreign laws and regulations governing the use, manufacture, storage, handling and disposal of these hazardous materials. Although we believe that our safety procedures for handling and disposing of these materials comply with the standards prescribed by these laws and regulations, we cannot eliminate the risk of accidental contamination or injury from these materials. In addition, if we develop a manufacturing capacity, we may incur substantial costs to comply with environmental regulations and would be subject to the risk of accidental contamination or injury from the use of hazardous materials in our manufacturing process.

In the event of an accident, government authorities may curtail our use of these materials and interrupt our business operations. In addition, we could be liable for any civil damages that result, which may exceed our financial resources and may seriously harm our business. Although our Israeli insurance program covers certain unforeseen sudden pollutions, we do not maintain a separate insurance policy for any of the foregoing types of risks. In addition, although the general liability section of our life sciences policy covers certain unforeseen, sudden environmental issues, pollution in the United States and Canada is excluded from the policy. In the event of environmental discharge or contamination or an accident, we may be held liable for any resulting damages, and any liability could exceed our resources. In addition, we may be subject to liability and may be required to comply with new or existing environmental laws regulating pharmaceuticals or other medical products in the environment.

15

Environmental, social and corporate governance (ESG) issues, including those related to climate change and sustainability, may have an adverse effect on our business, financial condition and results of operations and damage our reputation.

There is an increasing focus from certain investors, customers, consumers, employees and other stakeholders concerning ESG matters. Additionally, public interest and legislative pressure related to public companies’ ESG practices continue to grow. If our ESG practices fail to meet regulatory requirements or investor, customer, consumer, employee or other shareholders’ evolving expectations and standards for responsible corporate citizenship in areas including environmental stewardship, support for local communities, Board of Director and employee diversity, human capital management, employee health and safety practices, product quality, supply chain management, corporate governance and transparency, our reputation, brand and employee retention may be negatively impacted, and our customers and suppliers may be unwilling to continue to do business with us.

Customers, consumers, investors and other shareholders are increasingly focusing on environmental issues, including climate change, energy and water use, plastic waste and other sustainability concerns. Concern over climate change may result in new or increased legal and regulatory requirements to reduce or mitigate impacts to the environment. Changing customer and consumer preferences or increased regulatory requirements may result in increased demands or requirements regarding plastics and packaging materials, including single-use and non-recyclable plastic products and packaging, other components of our products and their environmental impact on sustainability, or increased customer and consumer concerns or perceptions (whether accurate or inaccurate) regarding the effects of substances present in certain of our products. Complying with these demands or requirements could cause us to incur additional manufacturing, operating or product development costs.

If we do not adapt to or comply with new regulations, including the SEC’s newly adopted rules that would require companies to provide expanded climate-related disclosures in their periodic reporting, which may require us to incur significant additional costs to comply and impose increased oversight obligations on our management and board of directors, or fail to meet evolving investor, industry or stakeholder expectations and concerns regarding ESG issues, investors may reconsider their capital investment in our Company, we may become subject to penalties, and customers and consumers may choose to stop purchasing our products, if approved for commercialization, which could have a material adverse effect on our reputation, business or financial condition.

Our business and operations may be materially adversely affected in the event of computer system failures or security breaches.

Despite the implementation of security measures, our internal computer systems, and those of our contract research organizations, or CROs, and other third parties on which we rely, are vulnerable to damage from computer viruses, unauthorized access, cyber-attacks, natural disasters, fire, terrorism, war, and telecommunication and electrical failures. If such an event were to occur and interrupt our operations, it could result in a material disruption of our drug development programs. For example, the loss of clinical trial data from ongoing or planned clinical trials could result in delays in our regulatory approval efforts and significantly increase our costs to recover or reproduce the data. To the extent that any disruption or security breach results in a loss of or damage to our data or applications, loss of trade secrets or inappropriate disclosure of confidential or proprietary information, including protected health information or personal data of employees or former employees, access to our clinical data, or disruption of the manufacturing process, we could incur liability and the further development of our drug candidates could be delayed. We may also be vulnerable to cyber-attacks by hackers or other malfeasance. This type of breach of our cybersecurity may compromise our confidential information and/or our financial information and adversely affect our business or result in legal proceedings. Further, these cybersecurity breaches may inflict reputational harm upon us that may result in decreased market value and erode public trust.

We may not be able to successfully grow and expand our business. Failure to manage our growth effectively will have a material adverse effect on our business, results of operations and financial condition.