SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

Form 20-F

☐ REGISTRATION STATEMENT PURSUANT TO SECTION 12(b) OR (g) OF THE SECURITIES EXCHANGE ACT OF 1934

Or

☒ ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the fiscal year ended December 31, 2017

Or

☐ TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

Or

☐ SHELL COMPANY REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

Commission File No. 001-36203

Can-Fite BioPharma Ltd.

(Exact name of Registrant as specified in its charter)

Can-Fite BioPharma Ltd., an Israeli Limited Company

(Translation of the Registrant’s name into English)

Israel

(Jurisdiction of incorporation)

10 Bareket Street,

Kiryat Matalon,

P.O. Box 7537,

Petah-Tikva

4951778, Israel

(Address of principal executive offices)

Motti Farbstein

Chief Operating and Financial Officer

Tel: +972 (3) 924-1114

Fax: +972 (3) 924-9378

motti@canfite.co.il

10 Bareket Street,

Kiryat Matalon,

P.O. Box 7537,

Petah-Tikva

4951778, Israel

(Name, Telephone, E-mail and/or Facsimile number and Address of Company Contact Person)

Securities registered or to be registered pursuant to Section 12(b) of the Act:

American Depositary Shares, each representing 2 Ordinary Shares, par value NIS 0.25 per share

(Title of Class)

Ordinary Shares, par value NIS 0.25 per share*

(Title of Class)

Securities registered or to be registered pursuant to Section 12(g) of the Act:

None

Securities for which there is a reporting obligation pursuant to Section 15(d) of the Act:

None

* Not for trading, but only in connection with the registration of the American Depositary Shares.

Indicate the number of outstanding shares of each of the issuer’s classes of capital or common stock as of the close of the period covered by the annual report (December 31, 2017): 33,295,618 ordinary shares are outstanding.

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes ☐ No ☒

If this report is an annual or transition report, indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934. Yes ☐ No ☒

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such a shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes ☒ No ☐

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate website, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). Yes ☐ No ☐

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or an emerging growth company. See definition of “large accelerated filer,” “accelerated filer,” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

| Large accelerated filer | ☐ | Accelerated filer | ☐ | Non-accelerated filer | ☒ |

| Emerging growth company | ☒ |

If an emerging growth company that prepares its financial statements in accordance with U.S. GAAP, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 7(a)(2)(B) of the Securities Act. ☐

Indicate by check mark which basis of accounting the registrant has used to prepare the financial statements included in this filing:

| U.S. GAAP ☐ | International Financial Reporting Standards | Other ☐ |

| as issued by the International Accounting Standards Board ☒ |

If “Other” has been checked in response to the previous question, indicate by check mark which financial statement item the Registrant has elected to follow: Item 17 ☐ Item 18 ☐

If this is an annual report, indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes ☐ No ☒

| i |

INTRODUCTION

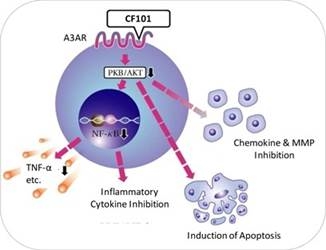

Can-Fite is a clinical-stage biopharmaceutical company focused on developing orally bioavailable small molecule therapeutic products for the treatment of cancer, inflammatory disease and sexual dysfunction. Our platform technology utilizes the Gi protein associated A3AR as a therapeutic target. A3AR is highly expressed in inflammatory and cancer cells, and not significantly expressed in normal cells, suggesting that the receptor could be a unique target for pharmacological intervention. Our pipeline of drug candidates are synthetic, highly specific agonists and allosteric modulators, or ligands or molecules that initiate molecular events when binding with target proteins, targeting the A3AR.

Our ordinary shares have been trading on the Tel Aviv Stock Exchange, or TASE, under the symbol “CFBI” since October 2005. On October 2, 2012, our ADSs began trading over the counter, or OTC, in the United States under the symbol “CANFY” and on November 19, 2013, our ADSs began trading on the NYSE American under the symbol “CANF.”

Unless otherwise indicated, all references to the “Company,” “we,” “our” and “Can-Fite” refer to Can-fite BioPharma Ltd. and its consolidated subsidiaries. References to “ordinary shares”, “ADSs”, “warrants” and “share capital” refer to the ordinary shares, ADSs, warrants and share capital, respectively, of Can-Fite.

References to “U.S. dollars” and “$” are to currency of the United States of America, and references to “NIS” are to New Israeli Shekels. References to “ordinary shares” are to our ordinary shares, par value of NIS 0.25 per share. We report financial information under International Financial Reporting Standards, or IFRS, as issued by the International Accounting Standards Board and none of the financial statements were prepared in accordance with generally accepted accounting principles in the United States.

Unless otherwise indicated, U.S. dollar translations of NIS amounts presented in this Annual Report on Form 20-F for the year ended on December 31, 2017 are translated using the rate of NIS 3.467 to $1.00, the exchange rate reported by the Bank of Israel on December 31, 2017, U.S. dollar translations of NIS amounts presented in this Annual Report on Form 20-F for the year ended on December 31, 2016 are translated using the rate of NIS 3.845to $1.00, the exchange rate reported by the Bank of Israel on December 31, 2016, and U.S. dollar translations of NIS amounts presented in this Annual Report on Form 20-F for the year ended on December 31, 2015 are translated using the rate of NIS3.902 to $1.00, the exchange rate reported by the Bank of Israel on December 31, 2015.

| ii |

FORWARD LOOKING STATEMENTS

This Annual Report on Form 20-F contains forward-looking statements, about our expectations, beliefs or intentions regarding, among other things, our product development efforts, business, financial condition, results of operations, strategies or prospects. In addition, from time to time, we or our representatives have made or may make forward-looking statements, orally or in writing. Forward-looking statements can be identified by the use of forward-looking words such as “believe,” “expect,” “intend,” “plan,” “may,” “should” or “anticipate” or their negatives or other variations of these words or other comparable words or by the fact that these statements do not relate strictly to historical or current matters. These forward-looking statements may be included in, but are not limited to, various filings made by us with the U.S. Securities and Exchange Commission, or the SEC, press releases or oral statements made by or with the approval of one of our authorized executive officers. Forward-looking statements relate to anticipated or expected events, activities, trends or results as of the date they are made. Because forward-looking statements relate to matters that have not yet occurred, these statements are inherently subject to risks and uncertainties that could cause our actual results to differ materially from any future results expressed or implied by the forward-looking statements. Many factors could cause our actual activities or results to differ materially from the activities and results anticipated in forward-looking statements, including, but not limited to, the factors summarized below.

This Annual Report on Form 20-F identifies important factors which could cause our actual results to differ materially from those indicated by the forward-looking statements, particularly those set forth under the heading “Risk Factors.” The risk factors included in this Annual Report on Form 20-F are not necessarily all of the important factors that could cause actual results to differ materially from those expressed in any of our forward-looking statements. Given these uncertainties, readers are cautioned not to place undue reliance on such forward-looking statements. Factors that could cause our actual results to differ materially from those expressed or implied in such forward-looking statements include, but are not limited to:

| ● | our history of losses and needs for additional capital to fund our operations and our inability to obtain additional capital on acceptable terms, or at all; | |

| ● | uncertainties of cash flows and inability to meet working capital needs; | |

| ● | the initiation, timing, progress and results of our preclinical studies, clinical trials and other product candidate development efforts; |

| ● | our ability to advance our product candidates into clinical trials or to successfully complete our preclinical studies or clinical trials; |

| ● | our receipt of regulatory approvals for our product candidates, and the timing of other regulatory filings and approvals; |

| ● | the clinical development, commercialization and market acceptance of our product candidates; |

| ● | our ability to establish and maintain strategic partnerships and other corporate collaborations; |

| ● | the implementation of our business model and strategic plans for our business and product candidates; |

| ● | the scope of protection we are able to establish and maintain for intellectual property rights covering our product candidates and our ability to operate our business without infringing the intellectual property rights of others; |

| ● | competitive companies, technologies and our industry; and |

| ● | statements as to the impact of the political and security situation in Israel on our business. |

All forward-looking statements attributable to us or persons acting on our behalf speak only as of the date of this Annual Report on Form 20-F and are expressly qualified in their entirety by the cautionary statements included in this Annual Report on Form 20-F. We undertake no obligations to update or revise forward-looking statements to reflect events or circumstances that arise after the date made or to reflect the occurrence of unanticipated events. In evaluating forward-looking statements, you should consider these risks and uncertainties.

| iii |

EXPLANATORY NOTE

Market data and certain industry data and forecasts used throughout this Annual Report on Form 20-F were obtained from internal company surveys, market research, consultant surveys, publicly available information, reports of governmental agencies and industry publications and surveys. Industry surveys, publications, consultant surveys and forecasts generally state that the information contained therein has been obtained from sources believed to be reliable, but that the accuracy and completeness of such information is not guaranteed. We have not independently verified any of the data from third-party sources, nor have we ascertained the underlying economic assumptions relied upon therein. Similarly, internal surveys, industry forecasts and market research, which we believe to be reliable based upon our management’s knowledge of the industry, have not been independently verified. Forecasts are particularly likely to be inaccurate, especially over long periods of time. In addition, we do not necessarily know what assumptions regarding general economic growth were used in preparing the forecasts we cite. Statements as to our market position are based on the most currently available data. While we are not aware of any misstatements regarding the industry data presented in this Annual Report on Form 20-F, our estimates involve risks and uncertainties and are subject to change based on various factors, including those discussed under the heading “Risk Factors” in this Annual Report on Form 20-F.

| iv |

ITEM 1. Identity of Directors, Senior Management and Advisers.

Not applicable.

ITEM 2. Offer Statistics and Expected Timetable.

Not applicable.

A. Selected Financial Data.

The following table sets forth our selected consolidated financial data for the periods ended and as of the dates indicated. The following selected consolidated financial data for our company should be read in conjunction with the financial information, “Item 5. Operational and Financial Review and Prospects” and other information provided elsewhere in this Annual Report on Form 20-F and our consolidated financial statements and related notes. The selected consolidated financial data in this section is not intended to replace the consolidated financial statements and is qualified in its entirety thereby.

The selected consolidated statements of operations data for the years ended December 31, 2017, 2016 and 2015, and the selected consolidated balance sheet data as of December 31, 2017 and 2016, have been derived from our audited consolidated financial statements set forth elsewhere in this Annual Report on Form 20-F. The selected consolidated statements of operations data for the years ended December 31, 2014 and 2013, and the selected consolidated balance sheet data as of December 31, 2015, 2014 and 2013, have been derived from our audited consolidated financial statements not included in this Form 20-F.

Our consolidated financial statements included in this Annual Report on Form 20-F were prepared in accordance with International Financial Reporting Standards, or IFRS, as issued by the International Accounting Standards Board, and reported in Israeli New Shekels, or NIS.

| Consolidated Statements Of | Year Ended December 31, | |||||||||||||||||||||||

| Operations Data: | 2013 | 2014 | 2015 | 2016 | 2017 | 2017 | ||||||||||||||||||

| (in thousands, except share and per share data) | ||||||||||||||||||||||||

| NIS | Convenience translation to US $ | |||||||||||||||||||||||

| Revenues | - | - | 643 | 652 | 2,936 | 847 | ||||||||||||||||||

| Operating expenses: | ||||||||||||||||||||||||

| Research and development expenses, net | 15,390 | 16,200 | 15,052 | 23,380 | 18,322 | 5,285 | ||||||||||||||||||

| General and administrative expenses | 15,922 | 11,573 | 10,633 | 10,483 | 10,249 | 2,956 | ||||||||||||||||||

| Operating loss | 31,312 | 27,773 | 25,042 | 33,211 | 25,635 | 7,394 | ||||||||||||||||||

| Other income | - | - | - | - | (1,853 | ) | (534 | ) | ||||||||||||||||

| Financial expenses | 892 | 1,228 | 2,203 | 685 | 3,822 | 1,102 | ||||||||||||||||||

| Financial income | (1401 | ) | (4,500 | ) | (7,492 | ) | (6,999 | ) | (10,397 | ) | (2,999 | ) | ||||||||||||

| Taxes on income | 9 | 23 | 17 | 112 | 104 | 30 | ||||||||||||||||||

| Net loss | 30,812 | 24,524 | 19,770 | 27,009 | 17,311 | 4,993 | ||||||||||||||||||

| Adjustments arising from translating financial statements of foreign operations | 206 | 939 | 1 | 33 | 95 | 27 | ||||||||||||||||||

| Remeasurements loss (gain) from defined benefit plan | 49 | 94 | 385 | - | - | - | ||||||||||||||||||

| Comprehensive loss | 31,067 | 25, 557 | 20,156 | 27,042 | 17,406 | 5,020 | ||||||||||||||||||

| Net loss per ordinary share | 2.12 | 1.35 | 0.81 | 0.96 | 0.53 | 0.15 | ||||||||||||||||||

| Number of ordinary shares used in computing loss per ordinary share | 13,712,521 | 17,545,663 | 22,953,077 | 27,709,901 | 32,525,138 | 32,525,138 | ||||||||||||||||||

1

| Consolidated Balance | As of December 31, | |||||||||||||||||||||||

| Sheet Data: | 2013 | 2014 | 2015 | 2016 | 2017 | 2017 | ||||||||||||||||||

| (in thousands NIS) | (in thousands NIS) | (in thousands NIS) | (in thousands NIS) | (in thousands NIS) | (in US $ thousands) | |||||||||||||||||||

| Cash and cash equivalents | 20,767 | 36,091 | 66,026 | 31,203 | 12,154 | 3,506 | ||||||||||||||||||

| Other receivables and lease deposit | 2,195 | 3,443 | 2,446 | 7,701 | 11,729 | 3,383 | ||||||||||||||||||

| long-term investments | - | - | - | - | 3,179 | 917 | ||||||||||||||||||

| Fixed assets | 143 | 133 | 236 | 205 | 160 | 46 | ||||||||||||||||||

| Total assets | 23,105 | 39,667 | 68,708 | 39,109 | 27,222 | 7,852 | ||||||||||||||||||

| Total liabilities | 7,580 | 12,967 | 27,935 | 24,207 | 16,608 | 4,791 | ||||||||||||||||||

| Total shareholders’ equity | 15,525 | 26,700 | 40,773 | 14,902 | 10,614 | 3,061 | ||||||||||||||||||

The following table sets forth information regarding the exchange rates of U.S. dollars per NIS for the periods indicated. Average rates are calculated by using the daily representative rates as reported by the Bank of Israel on the last day of each month during the periods presented.

| NIS per U.S. $ | ||||||||||||||||

| Year Ended December 31, | High | Low | Average | Period End | ||||||||||||

| 2017 | 3.86 | 3.467 | 3.5997 | 3.467 | ||||||||||||

| 2016 | 3.983 | 3.746 | 3.841 | 3.845 | ||||||||||||

| 2015 | 4.053 | 3.761 | 3.887 | 3.902 | ||||||||||||

| 2014 | 3.994 | 3.402 | 3.578 | 3.889 | ||||||||||||

| 2013 | 3.791 | 3.471 | 3.611 | 3.471 | ||||||||||||

The following table sets forth the high and low daily representative rates for the NIS as reported by the Bank of Israel for each of the prior six months. Average rates are calculated by using the daily representative rates as reported by the Bank of Israel on the last day of each month during the periods presented.

| NIS per U.S. $ | ||||||||||||||||

| Month Ended | High | Low | Average | Period End | ||||||||||||

| March 2018 (through March 25, 2017) | 3.4950 | 3.4310 | 3.4611 | 3.4910 | ||||||||||||

| February 2018 | 3.5433 | 3.4278 | 3.4904 | 3.466 | ||||||||||||

| January 2018 | 3.4738 | 3.3926 | 3.4232 | 3.405 | ||||||||||||

| December 2017 | 3.5494 | 3.467 | 3.5035 | 3.467 | ||||||||||||

| November 2017 | 3.5455 | 3.4934 | 3.5172 | 3.499 | ||||||||||||

| October 2017 | 3.5371 | 3.4872 | 3.5124 | 3.521 | ||||||||||||

| September 2017 | 3.5794 | 3.4874 | 3.5374 | 3.529 | ||||||||||||

On March 25, 2018, the closing representative rate was $1.00 to NIS 3.4910, as reported by the Bank of Israel.

B. Capitalization and Indebtedness.

Not applicable.

C. Reasons for the Offer and Use of Proceeds.

Not applicable.

D. Risk Factors

You should carefully consider the risks we describe below, in addition to the other information set forth elsewhere in this Annual Report on Form 20-F, including our consolidated financial statements and the related notes beginning on page F-1, before deciding to invest in our ordinary shares and American Depositary Shares, or ADSs. These material risks could adversely impact our results of operations, possibly causing the trading price of our ordinary shares and ADSs to decline, and you could lose all or part of your investment.

2

Risks Related to Our Financial Position and Capital Requirements

We have incurred operating losses since our inception and anticipate that we will continue to incur substantial operating losses for the foreseeable future.

We are a clinical stage biopharmaceutical company that develops orally bioavailable small molecule therapeutic products for the treatment of cancer, inflammatory diseases and sexual dysfunction. Since our incorporation in 1994, we have been focused on research and development activities with a view to developing our product candidates, CF101also known as Piclidenoson, CF102, also known as Namodenoson, and CF602. We have financed our operations primarily through the sale of equity securities (both in private placements and in public offerings on the Tel Aviv Stock Exchange, or TASE and NYSE American) and payments received under out-licensing agreements and have incurred losses in each year since our inception in 1994. We have historically incurred substantial net losses, including net losses of approximately NIS 17.3 million (approximately $4.9 million) in 2017, NIS 27 million (approximately $7 million) in 2016, and NIS 20 million (approximately $5 million) in 2015. At December 31, 2017, we had an accumulated deficit of approximately NIS 367.2 million (approximately $105.9 million). We do not know whether or when we will become profitable. To date, we have not commercialized any products or generated any revenues from product sales and accordingly we do not have a revenue stream to support our cost structure. Our losses have resulted principally from costs incurred in development and discovery activities. We expect to continue to incur losses for the foreseeable future, and these losses will likely increase as we:

| ● | initiate and manage pre-clinical development and clinical trials for our current and new product candidates; |

| ● | seek regulatory approvals for our product candidates; |

| ● | implement internal systems and infrastructures; |

| ● | seek to license additional technologies to develop; |

| ● | hire management and other personnel; and |

| ● | move towards commercialization. |

If our product candidates fail in clinical trials or do not gain regulatory clearance or approval, or if our product candidates do not achieve market acceptance, we may never become profitable. Even if we do achieve profitability, we may not be able to sustain or increase profitability on a quarterly or annual basis. Our inability to achieve and then maintain profitability would negatively affect our business, financial condition, results of operations and cash flows. Moreover, our prospects must be considered in light of the risks and uncertainties encountered by an early-stage company and in highly regulated and competitive markets, such as the biopharmaceutical market, where regulatory approval and market acceptance of our products are uncertain. There can be no assurance that our efforts will ultimately be successful or result in revenues or profits.

We will need to raise additional capital to meet our business requirements in the future, and such capital raising may be costly or difficult to obtain and will dilute current shareholders’ ownership interests.

As of December 31, 2017 we had cash and cash equivalents of approximately NIS 12.1 million (approximately $3.5 million). During the first quarter of 2018, we received approximately NIS 7.4 million ($2.2 million) from Gebro Holdings GmbH, or Gebro, as upfront and milestone payments for entering into a distribution agreement with Gebro and on March 13, 2018, we raised approximately NIS 17.3 million (approximately $5 million) in a registered direct offering and concurrent private placement. We believe that our existing financial resources will be sufficient to meet our requirements for the next twelve months. We have expended and believe that we will continue to expend substantial resources for the foreseeable future developing our product candidates. These expenditures will include costs associated with research and development, manufacturing, conducting preclinical experiments and clinical trials and obtaining regulatory approvals, as well as commercializing any products approved for sale. Because the outcome of our planned and anticipated clinical trials is highly uncertain, we cannot reasonably estimate the actual amounts necessary to successfully complete the development and commercialization of our product candidates. In addition, other unanticipated costs may arise. As a result of these and other factors currently unknown to us, we will require additional funds, through public or private equity or debt financings or other sources, such as strategic partnerships and alliances and licensing arrangements. In addition, we may seek additional capital due to favorable market conditions or strategic considerations even if we believe we have sufficient funds for our current or future operating plans.

Our future capital requirements will depend on many factors, including the progress and results of our clinical trials, the duration and cost of discovery and preclinical development, and laboratory testing and clinical trials for our product candidates, the timing and outcome of regulatory review of our product candidates, the number and development requirements of other product candidates that we pursue, and the costs of activities, such as product marketing, sales, and distribution. Because of the numerous risks and uncertainties associated with the development and commercialization of our product candidates, we are unable to estimate the amounts of increased capital outlays and operating expenditures associated with our anticipated clinical trials.

3

Our future capital requirements depend on many factors, including:

●

● |

the level of research and development investment required to develop our product candidates;

the failure to obtain regulatory approval or achieve commercial success of our product candidates, including Piclidenoson, Namodenoson and CF602; |

| ● | the results of our preclinical studies and clinical trials for our earlier stage product candidates, and any decisions to initiate clinical trials if supported by the preclinical results; |

| ● | the costs, timing and outcome of regulatory review of our product candidates that progress to clinical trials; |

| ● | the costs of preparing, filing and prosecuting patent applications, maintaining and enforcing our issued patents and defending intellectual property-related claims; |

| ● | the cost of commercialization activities if any of our product candidates are approved for sale, including marketing, sales and distribution costs; |

| ● | the cost of manufacturing our product candidates and any products we successfully commercialize; |

| ● | the timing, receipt and amount of sales of, or royalties on, our future products, if any; |

| ● | the expenses needed to attract and retain skilled personnel; |

| ● | any product liability or other lawsuits related to our products; |

| ● | the extent to which we acquire or invest in businesses, products or technologies and other strategic relationships; |

| ● | the costs of financing unanticipated working capital requirements and responding to competitive pressures; and | |

| ● | maintaining minimum shareholders’ equity requirements and complying with other continue listing standards under the NYSE American Company Guide. |

Additional funds may not be available when we need them, on terms that are acceptable to us, or at all. If adequate funds are not available to us on a timely basis, we may be required to delay, limit, reduce or terminate preclinical studies, clinical trials or other research and development activities for one or more of our product candidates or delay, limit, reduce or terminate our establishment of sales and marketing capabilities or other activities that may be necessary to commercialize our product candidates.

We may incur substantial costs in pursuing future capital financing, including investment banking fees, legal fees, accounting fees, securities law compliance fees, printing and distribution expenses and other costs. We may also be required to recognize non-cash expenses in connection with certain securities we issue, such as convertible notes and warrants, which may adversely impact our financial condition.

Raising additional capital may cause dilution to our existing stockholders, restrict our operations or require us to relinquish rights to our technologies or product candidates.

We may seek additional capital through a combination of private and public equity offerings, debt financings, strategic partnerships and alliances and licensing arrangements. To the extent that we raise additional capital through the sale of equity or convertible debt securities, the ownership interests of existing shareholders will be diluted, and the terms may include liquidation or other preferences that adversely affect shareholder rights. Debt financing, if available, may involve agreements that include covenants limiting or restricting our ability to take certain actions, such as incurring debt, making capital expenditures or declaring dividends. If we raise additional funds through strategic partnerships and alliances and licensing arrangements with third parties, we may have to relinquish valuable rights to our technologies or product candidates, or grant licenses on terms that are not favorable to us. If we are unable to raise additional funds through equity or debt financing when needed, we may be required to delay, limit, reduce or terminate our product development or commercialization efforts or grant rights to develop and market product candidates that we would otherwise prefer to develop and market ourselves.

4

Risks Related to our Business and Regulatory Matters

We have not yet commercialized any products or technologies, and we may never become profitable.

We have not yet commercialized any products or technologies, and we may never be able to do so. We do not know when or if we will complete any of our product development efforts, obtain regulatory approval for any product candidates incorporating our technologies or successfully commercialize any approved products. Even if we are successful in developing products that are approved for marketing, we will not be successful unless these products gain market acceptance for appropriate indications at favorable reimbursement rates. The degree of market acceptance of these products will depend on a number of factors, including:

| ● | the timing of regulatory approvals in the countries, and for the uses, we seek; |

| ● | the competitive environment; |

| ● | the establishment and demonstration in the medical community of the safety and clinical efficacy of our products and their potential advantages over existing therapeutic products; |

| ● | our ability to enter into distribution and other strategic agreements with pharmaceutical and biotechnology companies with strong marketing and sales capabilities; |

| ● | the adequacy and success of distribution, sales and marketing efforts; and |

| ● | the pricing and reimbursement policies of government and third-party payors, such as insurance companies, health maintenance organizations and other plan administrators. |

Physicians, patients, thirty-party payors or the medical community in general may be unwilling to accept, utilize or recommend, and in the case of third-party payors, cover any of our products or products incorporating our technologies. As a result, we are unable to predict the extent of future losses or the time required to achieve profitability, if at all. Even if we successfully develop one or more products that incorporate our technologies, we may not become profitable.

Our product candidates are at various stages of clinical and preclinical development and may never be commercialized.

Our product candidates are at various stages of clinical development and may never be commercialized. The progress and results of any future pre-clinical testing or future clinical trials are uncertain, and the failure of our product candidates to receive regulatory approvals will have a material adverse effect on our business, operating results and financial condition to the extent we are unable to commercialize any products. None of our product candidates has received regulatory approval for commercial sale. In addition, we face the risks of failure inherent in developing therapeutic products. Our product candidates are not expected to be commercially available for several years, if at all.

In addition, our product candidates must satisfy rigorous standards of safety and efficacy before they can be approved by the U.S. Food and Drug Administration, or the FDA, the European Medicines Agency, or EMA, and foreign regulatory authorities for commercial use. The FDA, EMA and foreign regulatory authorities have full discretion over this approval process. We will need to conduct significant additional research, involving testing in animals and in humans, before we can file applications for product approval. Typically, in the pharmaceutical industry, there is a high rate of attrition for product candidates in pre-clinical testing and clinical trials. Also, satisfying regulatory requirements typically takes many years, is dependent upon the type, complexity and novelty of the product and requires the expenditure of substantial resources. In addition, delays or rejections may be encountered based upon additional government regulation, including any changes in FDA policy, during the process of product development, clinical trials and regulatory reviews.

In order to receive FDA approval or approval from foreign regulatory authorities to market a product candidate or to distribute our products, we must demonstrate thorough pre-clinical testing and thorough human clinical trials that the product candidate is safe and effective for its intended uses (e.g., treatment of a specific condition in a specific way subject to contradictions and other limitations). Even if we comply with all FDA requests, the FDA may ultimately reject one or more of our new drug applications, or NDA, or grant approval for a narrowly intended use that is not commercially feasible. We might not obtain regulatory approval for our drug candidates in a timely manner, if at all. Failure to obtain FDA approval of any of our drug candidates in a timely manner or at all will severely undermine our business by reducing the number of salable products and, therefore, corresponding product revenues.

5

Results of earlier clinical trials may not be predictive of the results of later-stage clinical trials.

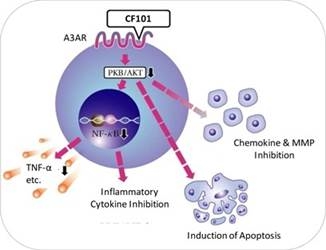

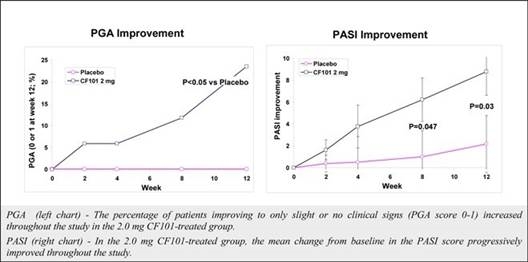

The results of preclinical studies and early clinical trials of product candidates may not be predictive of the results of later-stage clinical trials. Also, interim results, if at all, during a clinical trial do not necessarily predict final results. Product candidates in later stages of clinical trials may fail to show the desired safety and efficacy results despite having progressed through preclinical studies and initial clinical trials. For example, in December 2013, our former subsidiary OphthaliX Inc. (since renamed Wize Pharma, Inc.), or OphthaliX, announced top-line results of a Phase III study with Piclidenoson for dry-eye syndrome in which Piclidenoson did not meet the primary efficacy endpoint of complete clearing of corneal staining, nor the secondary efficacy endpoints and in July 2016, OphthaliX released top-line results from its Phase II clinical trial of Piclidenoson for the treatment of glaucoma in which no statistically significant differences were found between the Piclidenoson treated group and the placebo group in the primary endpoint of lowering intra ocular pressure. In addition, two Phase IIb studies in rheumatoid arthritis, or rheumatoid arthritis, utilizing Piclidenoson in combination with methotrexate, a generic drug commonly used for treating rheumatoid arthritis patients, or MTX, failed to reach their primary endpoints. Furthermore, a Phase II/III study of Piclidenoson for psoriasis did not meet its primary endpoint although positive data from further analysis of the Phase II/III study suggests Piclidenoson as a potential systemic therapy for patients with moderate-severe psoriasis.

Many companies in the pharmaceutical industry have suffered significant setbacks in advanced clinical trials due to adverse safety profiles or lack of efficacy, notwithstanding promising results in earlier studies. Any delay in, or termination or suspension of, our clinical trials will delay the requisite filings with the FDA, EMA or other foreign regulatory authorities and, ultimately, our ability to commercialize our product candidates and generate product revenues. If the clinical trials do not support our product claims, the completion of development of such product candidates may be significantly delayed or abandoned, which will significantly impair our ability to generate product revenues and will materially adversely affect our results of operations.

This drug candidate development risk is heightened by any changes in the planned clinical trials compared to the completed clinical trials. As product candidates are developed from preclinical through early to late stage clinical trials towards approval and commercialization, it is customary that various aspects of the development program, such as manufacturing and methods of administration, are altered along the way in an effort to optimize processes and results. While these types of changes are common and are intended to optimize the product candidates for late stage clinical trials, approval and commercialization, such changes do carry the risk that they will not achieve these intended objectives.

Changes in our planned clinical trials or future clinical trials could cause our product candidates to perform differently, including causing toxicities, which could delay completion of our clinical trials, delay approval of our product candidates, and/or jeopardize our ability to commence product sales and generate revenues.

We might be unable to develop product candidates that will achieve commercial success in a timely and cost-effective manner, or ever.

Even if regulatory authorities approve our product candidates, they may not be commercially successful. Our product candidates may not be commercially successful because government agencies and other third-party payors may not cover the product or the coverage may be too limited to be commercially successful; physicians and others may not use or recommend our products, even following regulatory approval. A product approval, assuming one issue, may limit the uses for which the product may be distributed thereby adversely affecting the commercial viability of the product. Third parties may develop superior products or have proprietary rights that preclude us from marketing our products. We also expect that at least some of our product candidates will be expensive, if approved. Patient acceptance of and demand for any product candidates for which we obtain regulatory approval or license will depend largely on many factors, including but not limited to the extent, if any, of reimbursement of costs by government agencies and other third-party payors, pricing, the effectiveness of our marketing and distribution efforts, the safety and effectiveness of alternative products, and the prevalence and severity of side effects associated with our products. If physicians, government agencies and other third-party payors do not accept our products, we will not be able to generate significant revenue.

Our current pipeline is based on our platform technology utilizing the Gi protein associated A3 adenosine receptor, or A3AR, as a potent therapeutic target and currently includes three molecules, Piclidenoson, Namodenoson and CF602 product candidates, of which Piclidenoson is the most advanced. Failure to develop these molecules will have a material adverse effect on us.

Our current pipeline is based on a platform technology where we target the A3AR with highly selective ligands, or small signal triggering molecules that bind to specific cell surface receptors, such as the A3AR, including Piclidenoson, Namodenoson and CF602. A3ARs are structures found in cell surfaces that record and transfer messages from small molecules or ligands, such as Piclidenoson, Namodenoson and CF602 to the rest of the cell. Piclidenoson is the most advanced of our drug candidates. As such, we are currently dependent on only three molecules for our potential commercial success, and any safety or efficacy concerns related to such molecules would have a significant impact on our business. Failure to develop our drug candidates, in whole or in part, will have a material adverse effect on us.

6

Clinical trials are very expensive, time-consuming and difficult to design and implement, and, as a result, we may suffer delays or suspensions in future trials which would have a material adverse effect on our ability to generate revenues.

Human clinical trials are very expensive and difficult to design and implement, in part because they are subject to rigorous regulatory requirements. Regulatory authorities, such as the FDA, may preclude clinical trials from proceeding. Additionally, the clinical trial process is time-consuming, failure can occur at any stage of the trials, and we may encounter problems that cause us to abandon or repeat clinical trials. The commencement and completion of clinical trials may be delayed by several factors, including:

| ● | unforeseen safety issues; |

| ● | determination of dosing issues; |

| ● | lack of effectiveness or efficacy during clinical trials; |

| ● | failure of third party suppliers to perform final manufacturing steps for the drug substance; |

| ● | slower than expected rates of patient recruitment and enrollment; |

| ● | lack of healthy volunteers and patients to conduct trials; |

| ● | inability to monitor patients adequately during or after treatment; |

| ● | failure of third party contract research organizations to properly implement or monitor the clinical trial protocols; |

| ● | failure of institutional review boards to approve our clinical trial protocols; |

| ● | inability or unwillingness of medical investigators and institutional review boards to follow our clinical trial protocols; and |

| ● | lack of sufficient funding to finance the clinical trials. |

We have experienced the risks involved with conducting clinical trials, including but not limited to, increased expense and delay and failure to meet end points of the trial. For example, in December 2013, OphthaliX, announced top-line results of a Phase III study with CF 101 for dry-eye syndrome in which Piclidenoson did not meet the primary efficacy endpoint of complete clearing of corneal staining, nor the secondary efficacy endpoints and in July 2016, OphthaliX released top-line results from its Phase II clinical trial of Piclidenoson for the treatment of glaucoma in which no statistically significant differences were found between the Piclidenoson treated group and the placebo group in the primary endpoint of lowering intra ocular pressure. In addition, two Phase IIb studies in rheumatoid arthritis, utilizing Piclidenoson in combination with methotrexate, a generic drug commonly used for treating rheumatoid arthritis patients, or MTX, failed to reach their primary end points. Furthermore, a Phase II/III study of Piclidenoson for psoriasis did not meet its primary endpoint although positive data from further analysis of the Phase II/III study suggests Piclidenoson as a potential systemic therapy for patients with moderate-severe psoriasis.

In addition, we or regulatory authorities may suspend our clinical trials at any time if it appears that we are exposing participants to unacceptable health risks or if the regulatory authorities find deficiencies in our regulatory submissions or the conduct of these trials. Any suspension of clinical trials will delay possible regulatory approval, if any, and adversely impact our ability to develop products and generate revenue.

If we acquire or license additional technology or product candidates, we may incur a number of costs, may have integration difficulties and may experience other risks that could harm our business and results of operations.

We may acquire and license additional product candidates and technologies. Any product candidate or technology we license from others or acquire will likely require additional development efforts prior to commercial sale, including extensive pre-clinical or clinical testing, or both, and approval by the FDA and applicable foreign regulatory authorities, if any. All product candidates are prone to risks of failure inherent in pharmaceutical product development, including the possibility that the product candidate or product developed based on licensed technology will not be shown to be sufficiently safe and effective for approval by regulatory authorities. In addition, we cannot assure you that any product candidate that we develop based on acquired or licensed technology that is granted regulatory approval will be manufactured or produced economically, successfully commercialized or widely accepted in the marketplace. Moreover, integrating any newly acquired product candidates could be expensive and time-consuming. If we cannot effectively manage these aspects of our business strategy, our business may not succeed.

7

The manufacture of our product candidates is a chemical synthesis process and if one of our materials suppliers encounters problems manufacturing our products, our business could suffer.

The FDA and foreign regulators require manufacturers to register manufacturing facilities. The FDA and foreign regulators also inspect these facilities to confirm compliance with requirements that the FDA or foreign regulators establish. We do not intend to engage in the manufacture of our products other than for pre-clinical and clinical studies, but we or our materials suppliers may face manufacturing or quality control problems causing product production and shipment delays or a situation where we or the supplier may not be able to maintain compliance with the FDA’s or foreign regulators’ requirements necessary to continue manufacturing our drug substance. Drug manufacturers are subject to ongoing periodic unannounced inspections by the FDA, the U.S. Drug Enforcement Agency, or DEA, and corresponding foreign regulators to ensure strict compliance with requirements and other governmental regulations and corresponding foreign standards. Any failure to comply with DEA requirements or FDA or foreign regulatory requirements could adversely affect our clinical research activities and our ability to market and develop our product candidates.

We do not currently have sales, marketing or distribution capabilities or experience, and we are unable to effectively sell, market or distribute our product candidates now and we do not expect to be able to do so in the future. The failure to enter into agreements with third parties that are capable of performing these functions would have a material adverse effect on our business and results of operations.

We do not currently have and we do not expect to develop sales, marketing and distribution capabilities. If we are unable to enter into agreements with third parties to perform these functions, we will not be able to successfully market any of our platforms or product candidates. In order to successfully market any of our platform or product candidates, we must make arrangements with third parties to perform these services.

As we do not intend to develop a marketing and sales force with technical expertise and supporting distribution capabilities, we will be unable to market any of our product candidates directly. To promote any of our potential products through third parties, we will have to locate acceptable third parties for these functions and enter into agreements with them on acceptable terms, and we may not be able to do so. Any third-party arrangements we are able to enter into may result in lower revenues than we could achieve by directly marketing and selling our potential products. In addition, to the extent that we depend on third parties for marketing and distribution, any revenues we receive will depend upon the efforts of such third parties, as well as the terms of our agreements with such third parties, which cannot be predicted in most cases at this time. As a result, we might not be able to market and sell our products in the United States or overseas, which would have a material adverse effect on us.

We will to some extent rely on third parties to implement our manufacturing and supply strategies. Failure of these third parties in any respect could have a material adverse effect on our business, results of operations and financial condition.

If our current and future manufacturing and supply strategies are unsuccessful, then we may be unable to conduct and complete any future pre-clinical or clinical trials or commercialize our product candidates in a timely manner, if at all. Completion of any potential future pre-clinical or clinical trials and commercialization of our product candidates will require access to, or development of, facilities to manufacture a sufficient supply of our product candidates. We do not have the resources, facilities or experience to manufacture our product candidates for commercial purposes on our own and do not intend to develop or acquire facilities for the manufacture of product candidates for commercial purposes in the foreseeable future. We may rely on contract manufacturers to produce sufficient quantities of our product candidates necessary for any pre-clinical or clinical testing we undertake in the future. Such contract manufacturers may be the sole source of production and they may have limited experience at manufacturing, formulating, analyzing, filling and finishing our types of product candidates.

We also intend to rely on third parties to supply the requisite materials needed for the manufacturing of our active pharmaceutical ingredients, or API. There may be a limited supply of these requisite materials. We might not be able to enter into agreements that provide us assurance of availability of such components in the future from any supplier. Our potential suppliers may not be able to adequately supply us with the components necessary to successfully conduct our pre-clinical and clinical trials or to commercialize our product candidates. If we cannot acquire an acceptable supply of the requisite materials to produce our product candidates, we will not be able to complete pre-clinical and clinical trials and will not be able to market or commercialize our product candidates.

We depend on key members of our management and key consultants and will need to add and retain additional leading experts. Failure to retain our management and consulting team and add additional leading experts could have a material adverse effect on our business, results of operations or financial condition.

We are highly dependent on our executive officers and other key management and technical personnel. Our failure to retain our Chief Executive Officer, Pnina Fishman, Ph.D., who has developed much of the technology we utilize today, or any other key management and technical personnel, could have a material adverse effect on our future operations. Our success is also dependent on our ability to attract, retain and motivate highly trained technical, and management personnel, among others, to continue the development and commercialization of our current and future products. We presently maintain a life insurance policy on our Chief Executive Officer, Pnina Fishman.

8

Our success also depends on our ability to attract, retain and motivate personnel required for the development, maintenance and expansion of our activities. There can be no assurance that we will be able to retain our existing personnel or attract additional qualified employees or consultants. The loss of key personnel or the inability to hire and retain additional qualified personnel in the future could have a material adverse effect on our business, financial condition and results of operation.

We face significant competition and continuous technological change, and developments by competitors may render our products or technologies obsolete or non-competitive. If we cannot successfully compete with new or existing products, our marketing and sales will suffer and we may not ever be profitable.

We will compete against fully integrated pharmaceutical and biotechnology companies and smaller companies that are collaborating with larger pharmaceutical companies, academic institutions, government agencies and other public and private research organizations. In addition, many of these competitors, either alone or together with their collaborative partners, operate larger research and development programs than we do, and have substantially greater financial resources than we do, as well as significantly greater experience in:

| ● | developing drugs; |

| ● | undertaking pre-clinical testing and human clinical trials; |

| ● | obtaining FDA, addressing various regulatory matters and other regulatory approvals of drugs; |

| ● | formulating and manufacturing drugs; and |

| ● | launching, marketing and selling drugs. |

If our competitors develop and commercialize products faster than we do, or develop and commercialize products that are superior to our product candidates, our commercial opportunities will be reduced or eliminated. The extent to which any of our product candidates achieve market acceptance will depend on competitive factors, many of which are beyond our control. Competition in the biotechnology and biopharmaceutical industry is intense and has been accentuated by the rapid pace of technology development. Our competitors include large integrated pharmaceutical companies, biotechnology companies that currently have drug and target discovery efforts, universities, and public and private research institutions. Almost all of these entities have substantially greater research and development capabilities and financial, scientific, manufacturing, marketing and sales resources than we do. These organizations also compete with us to:

| ● | attract parties for acquisitions, joint ventures or other collaborations; |

| ● | license proprietary technology that is competitive with the technology we are developing; |

| ● | attract funding; and |

| ● | attract and hire scientific talent and other qualified personnel. |

Our competitors may succeed in developing and commercializing products earlier and obtaining regulatory approvals from the FDA or foreign regulators more rapidly than we do. Our competitors may also develop products or technologies that are superior to those we are developing, and render our product candidates or technologies obsolete or non-competitive. If we cannot successfully compete with new or existing products, our marketing and sales will suffer and we may not ever be profitable.

Our competitors currently include companies with marketed products and/or an advanced research and development pipeline. The major competitors in the rheumatoid arthritis and psoriasis therapeutic field include Amgen, Centocor, Pfizer, Novartis, Abbvie, Celgene, Eli Lilly, Janssen and more. Competitors in the hepatocellular carcinoma, also known as primary liver cancer, or HCC field include companies such as Bayer. Competitors in the non-alcoholic steatohepatitis, or NASH, field include companies such as Gilead, Genfit, Regato, Galmed, Raptor and Intercept. Competitors in the erectile dysfunction field include Pfizer, Eli Lilly and Bayer. See “Item 4. Information on the Company—B. Business Overview—Competition.”

Moreover, several companies have reported the commencement of research projects related to the A3AR. Such companies include CV Therapeutics Inc. (which was acquired by Gilead), King Pharmaceuticals R&D Inv. (which was acquired by Pfizer), Hoechst Marion Roussel Inc. (which was acquired by Aventis), Novo Nordisk A/S and Inotek Pharmaceuticals. However, to the best of our knowledge, there is no approved drug currently on the market which is similar to our A3AR agonists, nor are we aware of any allosteric modulatorin the A3AR product pipeline similar to our allosteric modulator with respect to chemical profile and mechanism of action.

9

We are subject to a purported class action lawsuit. This litigation could result in substantial damages and may divert management’s time and attention from our business.

On June 29, 2015, we received a lawsuit, filed with the District Court of Tel-Aviv, requesting recognition of this lawsuit as a class action. The lawsuit named the Company, its Chief Executive Officer and directors as defendants. The lawsuit alleges, among other things, that we misled the public with regard to disclosures concerning the efficacy of our drug candidate, Piclidenoson. The claimant alleges that he suffered personal damages of over NIS 73,000, while also claiming that our shareholders suffered damages of approximately NIS 125 million. On March 31, 2016, we filed a response to the lawsuit. On March 1, 2017, a hearing was held in the District Court on whether to certify the lawsuit as a class action. A final hearing on the certification was held on May 17, 2017. On July 18, 2017, the District Court of Tel-Aviv issued a ruling in which it denied the request to recognize the lawsuit as a class action and awarded us an amount of NIS 50,000 to pay our expenses in relation to such law suit. The claimant filed a petition with the Supreme Court appealing the District Court decision. On January 28, 2018, the Supreme Court issued a notice of procedures to be complied with by the relevant parties leading up to a formal hearing scheduled for December 5, 2018. We believe that the ruling of the District Court is not likely to be overturned. While we believe that the ruling of the District Court is not likely to be overturned, due to the inherent uncertainties that accompany litigation of this nature, there can be no assurance that we will be successful, and an adverse resolution of the lawsuit may result in damages beyond our insurance coverage, which could cause a risk of loss and expenditures that may adversely affect our financial condition and results of operations. Furthermore, this action may divert management’s time and attention from our business, and we could be forced to expend significant resources and pay significant costs and expenses, including legal fees, in connection with defending this lawsuit.

We may suffer losses from product liability claims if our product candidates cause harm to patients.

Any of our product candidates could cause adverse events. Although data from a pooled analysis of approximately 1,200 patients with inflammatory disease treated with Piclidenoson, indicates that Piclidenoson has a good safety profile and well tolerated at doses up to 4.0 mg administered twice daily for up to 12-32 weeks, there were incidences (albeit less than or equal to 5%) of adverse events in eight completed and fully analyzed trials in inflammatory disease. Such adverse events included nausea, diarrhea, abdominal pain, vomiting, constipation, common bacterial and viral syndromes (such as tonsillitis, otitis and respiratory and urinary tract infections), abdominal pain, vomiting, myalgia, arthralgia, dizziness, headache and pruritus. We observed an even lower incidence (less than or equal to 2%) of serious adverse events, although only one type of event was reported in more than a single Piclidenoson-treated subject, which was exacerbation of chronic obstructive lung disease reported in two subjects. Notwithstanding the foregoing, the placebo group in such studies had a higher incidence of overall adverse events than the pooled Piclidenoson groups. In addition, in normal volunteers, Piclidenoson at doses 3-4-fold higher than those to be used in therapeutic trials, but not at therapeutic doses, was associated with prolongation of the electrocardiographic QT intervals. No new safety concerns have been identified and no novel or unexpected safety concerns have appeared over 32 weeks of treatment in more recent trials.

There is also a risk that certain adverse events may not be observed in clinical trials, but may nonetheless occur in the future. If any of these adverse events occur, they may render our product candidates ineffective or harmful in some patients, and our sales would suffer, materially adversely affecting our business, financial condition and results of operations.

In addition, potential adverse events caused by our product candidates could lead to product liability lawsuits. If product liability lawsuits are successfully brought against us, we may incur substantial liabilities and may be required to limit the marketing and commercialization of our product candidates. Our business exposes us to potential product liability risks, which are inherent in the testing, manufacturing, marketing and sale of pharmaceutical products. We may not be able to avoid product liability claims. Product liability insurance for the pharmaceutical and biotechnology industries is generally expensive, if available at all. If, at any time, we are unable to obtain sufficient insurance coverage on reasonable terms or to otherwise protect against potential product liability claims, we may be unable to clinically test, market or commercialize our product candidates. A successful product liability claim brought against us in excess of our insurance coverage, if any, may cause us to incur substantial liabilities, and, as a result, our business, liquidity and results of operations would be materially adversely affected.

Our product candidates will remain subject to ongoing regulatory requirements even if they receive marketing approval, and if we fail to comply with these requirements, we could lose these approvals, and the sales of any approved commercial products could be suspended.

Even if we receive regulatory approval to market a particular product candidate, the product will remain subject to extensive regulatory requirements, including requirements relating to manufacturing, labeling, packaging, adverse event reporting, storage, advertising, promotion, distribution and recordkeeping. Even if regulatory approval of a product is granted, the approval may be subject to limitations on the uses for which the product may be marketed or the conditions of approval, or may contain requirements for costly post-marketing testing and surveillance to monitor the safety or efficacy of the product, which could negatively impact us or our collaboration partners by reducing revenues or increasing expenses, and cause the approved product candidate not to be commercially viable. In addition, as clinical experience with a drug expands after approval, typically because it is used by a greater number and more diverse group of patients after approval than during clinical trials, side effects and other problems may be observed after approval that were not seen or anticipated during pre-approval clinical trials or other studies. Any adverse effects observed after the approval and marketing of a product candidate could result in limitations on the use of or withdrawal of any approved products from the marketplace. Absence of long-term safety data may also limit the approved uses of our products, if any. If we fail to comply with the regulatory requirements of the FDA and other applicable U.S. and foreign regulatory authorities, or previously unknown problems with any approved commercial products, manufacturers or manufacturing processes are discovered, we could be subject to administrative or judicially imposed sanctions or other setbacks, including the following:

| ● | Restrictions on the products, manufacturers or manufacturing process; |

10

| ● | Warning letters; |

| ● | Civil or criminal penalties, fines and injunctions; |

| ● | Product seizures or detentions; |

| ● | Import or export bans or restrictions; |

| ● | Voluntary or mandatory product recalls and related publicity requirements; |

| ● | Suspension or withdrawal of regulatory approvals; |

| ● | Total or partial suspension of production, and |

| ● | Refusal to approve pending applications for marketing approval of new products or supplements to approved applications. |

If we or our collaborators are slow or unable to adapt to changes in existing regulatory requirements or adoption of new regulatory requirements or policies, marketing approval for our product candidates may be lost or cease to be achievable, resulting in decreased revenue from milestones, product sales or royalties, which would have a material adverse effect on our results of operations.

We deal with hazardous materials and must comply with environmental, health and safety laws and regulations, which can be expensive and restrict how we do business.

Our activities and those of our third-party manufacturers on our behalf involve the controlled storage, use and disposal of hazardous materials, including corrosive, explosive and flammable chemicals and other hazardous compounds. We and our manufacturers are subject to U.S. federal, state, local, Israeli and other foreign laws and regulations governing the use, manufacture, storage, handling and disposal of these hazardous materials. Although we believe that our safety procedures for handling and disposing of these materials comply with the standards prescribed by these laws and regulations, we cannot eliminate the risk of accidental contamination or injury from these materials. In addition, if we develop a manufacturing capacity, we may incur substantial costs to comply with environmental regulations and would be subject to the risk of accidental contamination or injury from the use of hazardous materials in our manufacturing process.

In the event of an accident, government authorities may curtail our use of these materials and interrupt our business operations. In addition, we could be liable for any civil damages that result, which may exceed our financial resources and may seriously harm our business. Although our Israeli insurance program covers certain unforeseen sudden pollutions, we do not maintain a separate insurance policy for any of the foregoing types of risks. In addition, although the general liability section of our life sciences policy covers certain unforeseen, sudden environmental issues, pollution in the United States and Canada is excluded from the policy. In the event of environmental discharge or contamination or an accident, we may be held liable for any resulting damages, and any liability could exceed our resources. In addition, we may be subject to liability and may be required to comply with new or existing environmental laws regulating pharmaceuticals or other medical products in the environment.

Our business and operations may be materially adversely affected in the event of computer system failures or security breaches.

Despite the implementation of security measures, our internal computer systems, and those of our CROs and other third parties on which we rely, are vulnerable to damage from computer viruses, unauthorized access, cyber-attacks, natural disasters, fire, terrorism, war, and telecommunication and electrical failures. If such an event were to occur and interrupt our operations, it could result in a material disruption of our drug development programs. For example, the loss of clinical trial data from ongoing or planned clinical trials could result in delays in our regulatory approval efforts and significantly increase our costs to recover or reproduce the data. To the extent that any disruption or security breach results in a loss of or damage to our data or applications, loss of trade secrets or inappropriate disclosure of confidential or proprietary information, including protected health information or personal data of employees or former employees, access to our clinical data, or disruption of the manufacturing process, we could incur liability and the further development of our drug candidates could be delayed. We may also be vulnerable to cyber-attacks by hackers or other malfeasance. This type of breach of our cybersecurity may compromise our confidential information and/or our financial information and adversely affect our business or result in legal proceedings. Further, these cybersecurity breaches may inflict reputational harm upon us that may result in decreased market value and erode public trust.

11

We may not be able to successfully grow and expand our business. Failure to manage our growth effectively will have a material adverse effect on our business, results of operations and financial condition.

We may not be able to successfully grow and expand. Successful implementation of our business plan will require management of growth, including potentially rapid and substantial growth, which will result in an increase in the level of responsibility for management personnel and place a strain on our human and capital resources. To manage growth effectively, we will be required to continue to implement and improve our operating and financial systems and controls to expand, train and manage our employee base. Our ability to manage our operations and growth effectively requires us to continue to expend funds to enhance our operational, financial and management controls, reporting systems and procedures and to attract and retain sufficient numbers of talented personnel. If we are unable to scale up and implement improvements to our control systems in an efficient or timely manner, or if we encounter deficiencies in existing systems and controls, then we will not be able to make available the products required to successfully commercialize our technology. Failure to attract and retain sufficient numbers of talented personnel will further strain our human resources and could impede our growth or result in ineffective growth. Moreover, the management, systems and controls currently in place or to be implemented may not be adequate for such growth, and the steps taken to hire personnel and to improve such systems and controls might not be sufficient. If we are unable to manage our growth effectively, it will have a material adverse effect on our business, results of operations and financial condition.

If we are unable to obtain adequate insurance, our financial condition could be adversely affected in the event of uninsured or inadequately insured loss or damage. Our ability to effectively recruit and retain qualified officers and directors could also be adversely affected if we experience difficulty in obtaining adequate directors’ and officers’ liability insurance.

We may not be able to obtain insurance policies on terms affordable to us that would adequately insure our business and property against damage, loss or claims by third parties. To the extent our business or property suffers any damages, losses or claims by third parties, which are not covered or adequately covered by insurance, our financial condition may be materially adversely affected.

We may be unable to maintain sufficient insurance as a public company to cover liability claims made against our officers and directors. If we are unable to adequately insure our officers and directors, we may not be able to retain or recruit qualified officers and directors to manage us.

Risks Related to Our Intellectual Property

The termination of the National Institute of Health, or NIH, license agreement between us and NIH due to patent expiration may diminish our proprietary position.

As a result of the termination of the NIH license agreement between us and the NIH in June 2015 due to patent expiration, we no longer hold rights to a family of composition of matter patents relating to Piclidenoson hat were licensed from NIH. Nevertheless, because Piclidenoson may be a new chemical entity, or NCE, following approval of an NDA, we, if we are the first applicant to obtain NDA approval, may be entitled to five years of data exclusivity in the United States with respect to such NCEs. Analogous data and market exclusivity provisions, of varying duration, may be available in Europe and other foreign jurisdictions. We also have rights under our pharmaceutical use issued patents with respect to Piclidenoson and Namodenoson, which provide patent exclusivity within our field of activity until the mid- to late-2020s. While we believe that we may be able to protect our exclusivity through such use patent portfolio and such period of exclusivity, the lack of composition of matter patent protection may diminish our ability to maintain a proprietary position for our intended uses of Piclidenoson. Moreover, we cannot be certain that we will be the first applicant to obtain an FDA approval for any indication of Piclidenoson and we cannot be certain that we will be entitled to NCE exclusivity. In addition, we have discontinued the prosecution of a family of pending patent applications under joint ownership of us and NIH pertaining to the use of A3AR agonists for the treatment of uveitis. Such diminution of our proprietary position could have a material adverse effect on our business, results of operation and financial condition.

We license from Leiden University intellectual property which protects certain small molecules which target the A3AR, in furtherance of our platform technology, and we could lose our rights to this license if a dispute with Leiden University arises or if we fail to comply with the financial and other terms of the license.

We have licensed intellectual property from Leiden University pursuant to a license agreement. The license agreement imposes certain payment, reporting, confidentiality and other obligations on us. In the event that we were to breach any of the obligations and fail to cure, Leiden University would have the right to terminate the license agreement. In addition, Leiden University has the right to terminate the license agreement upon our bankruptcy, insolvency, or receivership. If any dispute arises with respect to our arrangements with Leiden University, such dispute may disrupt our operations and may have a material adverse impact on us if resolved in a manner that is unfavorable to us.

12

The failure to obtain or maintain patents, licensing agreements, including our current licensing agreements, and other intellectual property could impact our ability to compete effectively.

To compete effectively, we need to develop and maintain a proprietary position with regard to our own technologies, intellectual property, licensing agreements, product candidates and business. Legal standards relating to the validity and scope of claims in the biotechnology and biopharmaceutical fields are still evolving. Therefore, the degree of future protection for our proprietary rights in our core technologies and any products that might be made using these technologies is also uncertain. The risks and uncertainties that we face with respect to our patents and other proprietary rights include the following:

| ● | while the patents we license have been issued, the pending patent applications we have filed may not result in issued patents or may take longer than we expect to result in issued patents; |

| ● | we may be subject to interference proceedings; |

| ● | we may be subject to opposition proceedings in foreign countries; |

| ● | any patents that are issued may not provide meaningful protection; |

| ● | we may not be able to develop additional proprietary technologies that are patentable; |

| ● | other companies may challenge patents licensed or issued to us or our customers; |

| ● | other companies may independently develop similar or alternative technologies, or duplicate our technologies; |

| ● | other companies may design around technologies we have licensed or developed; and |

| ● | enforcement of patents is complex, uncertain and expensive. |

If patent rights covering our products and methods are not sufficiently broad, they may not provide us with any protection against competitors with similar products and technologies. Furthermore, if the United States Patent and Trademark Office, or the USPTO, or foreign patent officers issue patents to us or our licensors, others may challenge the patents or design around the patents, or the patent office or the courts may invalidate the patents. Thus, any patents we own or license from or to third parties may not provide any protection against our competitors.

We cannot be certain that patents will be issued as a result of any pending applications, and we cannot be certain that any of our issued patents will give us adequate protection from competing products. For example, issued patents, including the patents licensed by us, may be circumvented or challenged, declared invalid or unenforceable, or narrowed in scope. In addition, since publication of discoveries in the scientific or patent literature often lags behind actual discoveries, we cannot be certain that we were the first to make our inventions or to file patent applications covering those inventions.

It is also possible that others may obtain issued patents that could prevent us from commercializing our products or require us to obtain licenses requiring the payment of significant fees or royalties in order to enable us to conduct our business. As to those patents that we have licensed, our rights depend on maintaining our obligations to the licensor under the applicable license agreement, and we may be unable to do so.

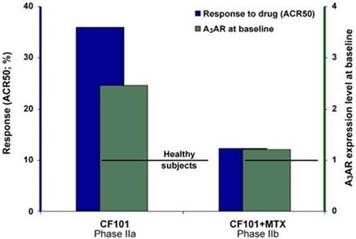

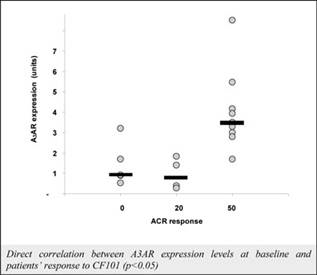

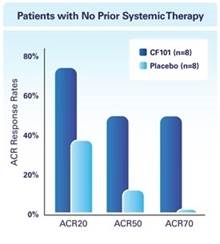

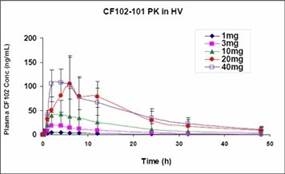

In addition to patents and patent applications, we depend upon trade secrets and proprietary know-how to protect our proprietary technology. We require our employees, consultants, advisors and collaborators to enter into confidentiality agreements that prohibit the disclosure of confidential information to any other parties. We require our employees and consultants to disclose and assign to us their ideas, developments, discoveries and inventions. These agreements may not, however, provide adequate protection for our trade secrets, know-how or other proprietary information in the event of any unauthorized use or disclosure.