Can - Fite Investor Presentation – Fall 2013 Pnina Fishman, PhD CEO

Page 2 This presentation contains forward - looking statements, about Can - Fite’s expectations, beliefs or intentions regarding, among other things, its product development efforts, business, financial condition, results of operations, strategies or prospects . In addition, from time to time, Can - Fite or its representatives have made or may make forward - looking statements, orally or in writing . Forward - looking statements can be identified by the use of forward - looking words such as “believe,” “expect,” “intend,” “plan,” “may,” “should” or “anticipate” or their negatives or other variations of these words or other comparable words or by the fact that these statements do not relate strictly to historical or current matters . These forward - looking statements may be included in, but are not limited to, various filings made by Can - Fite with the U . S . Securities and Exchange Commission (the “SEC”), press releases or oral statements made by or with the approval of one of Can - Fite’s authorized executive officers . Forward - looking statements relate to anticipated or expected events, activities, trends or results as of the date they are made . Because forward - looking statements relate to matters that have not yet occurred, these statements are inherently subject to risks and uncertainties that could cause Can - Fite’s actual results to differ materially from any future results expressed or implied by the forward - looking statements . Many factors could cause Can - Fite’s actual activities or results to differ materially from the activities and results anticipated in such forward - looking statements, including, but not limited to, the factors summarized in Can - Fite’s filings with the SEC and in its periodic filings with the Tel - Aviv Stock Exchange . FORWARD LOOKING STATEMENT

Page 3 » Can - Fite BioPharma - advanced clinical stage drug development company » Platform technology – A3 Adenosine Receptor Ligands small molecules; addressing multi - billion $ markets: • Autoimmune Inflammatory diseases • Cancer • Ophthalmic diseases » Clinical Development Stage - Phase II and Phase III clinical trials » Two out - licensing deals - for $ 21 . 8 million in up - front fees and milestone payments + royalties ; over $ 8 M has been received to date Company Profile TASE:CFBI / OTC:CANFY

Page 4 Equity Profile TASE:CFBI / OTC:CANFY Ticker on Israeli TASE: CFBI Ticker on OTCQB ADR Level II: CANFY Price of ADR: $6.29 (1 ADR = 2 Ordinary Shares) 52 Week Range: $3.30 - $7.00 Shares Out: 16.11 M Ordinary Shares Market Capitalization: $50.7 M Avg. Trading Volume (30 day): 17,284 ADRs As of October 28, 2013

Page 5 Scientific Concept TASE:CFBI / OTC:CANFY • Why does cancer not metastasize to muscle? • While most of the world asked “Why is there cancer?” we asked the opposite question. ?

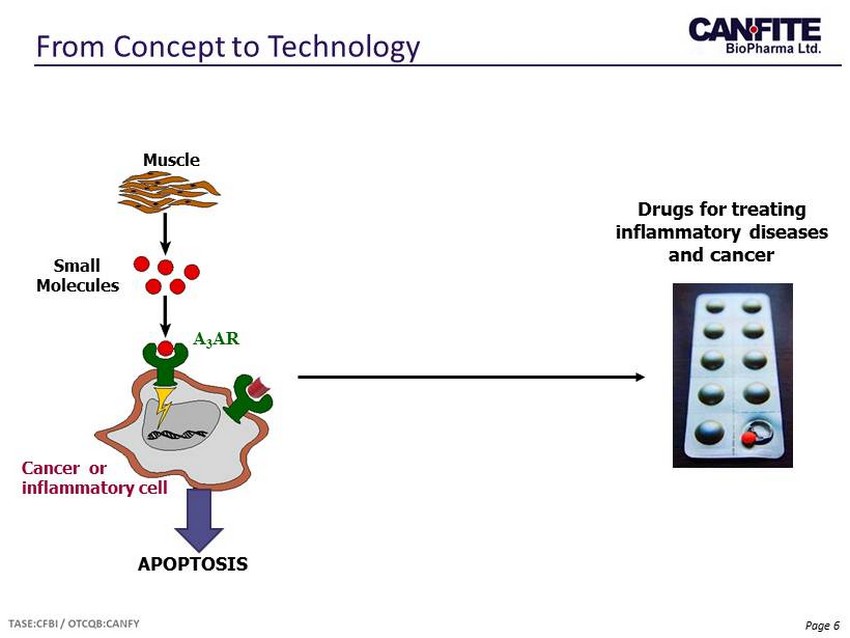

Page 6 Drugs for treating inflammatory diseases and cancer APOPTOSIS A 3 AR Muscle Small Molecules Cancer or inflammatory cell From Concept to Technology

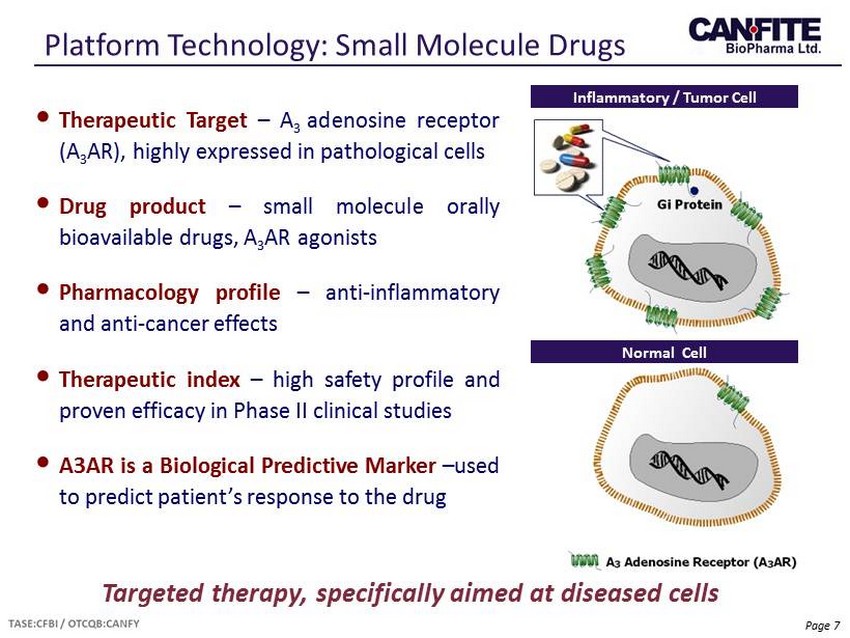

Page 7 Platform Technology: Small Molecule Drugs Targeted therapy, specifically aimed at diseased cells • Therapeutic Target – A 3 adenosine receptor (A 3 AR), highly expressed in pathological cells • Drug product – small molecule orally bioavailable drugs, A 3 AR agonists • Pharmacology profile – anti - inflammatory and anti - cancer effects • Therapeutic index – high safety profile and proven efficacy in Phase II clinical studies • A 3 AR is a Biological Predictive Marker – used to predict patient’s response to the drug Inflammatory / Tumor Cell Normal Cell

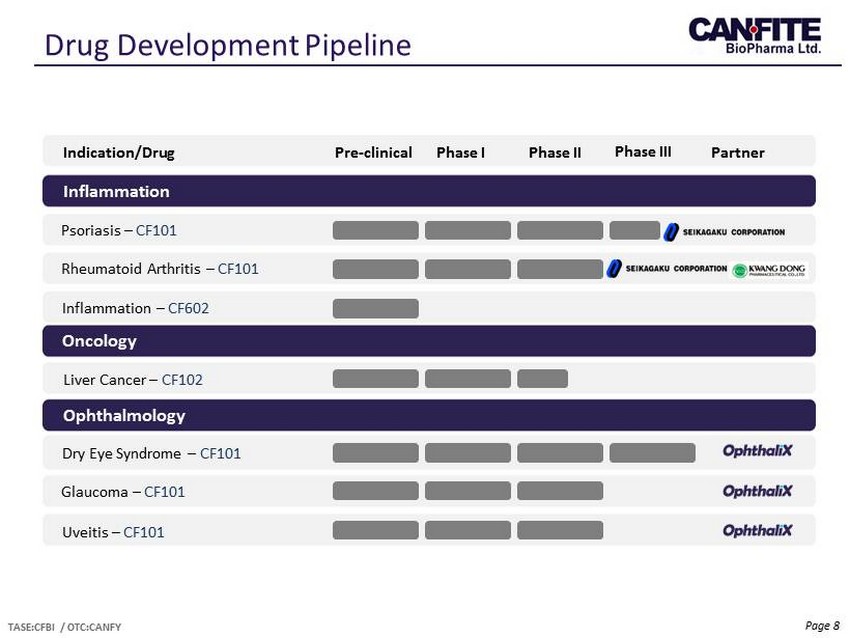

Page 8 Drug Development Pipeline TASE:CFBI / OTC:CANFY Indication/Drug Pre - clinical Phase I Phase II Phase III Inflammation Oncology Ophthalmology Psoriasis – CF101 Rheumatoid Arthritis – CF101 Inflammation – CF602 Liver Cancer – CF 102 Dry Eye Syndrome – CF101 Glaucoma – CF101 Uveitis – CF101 Partner

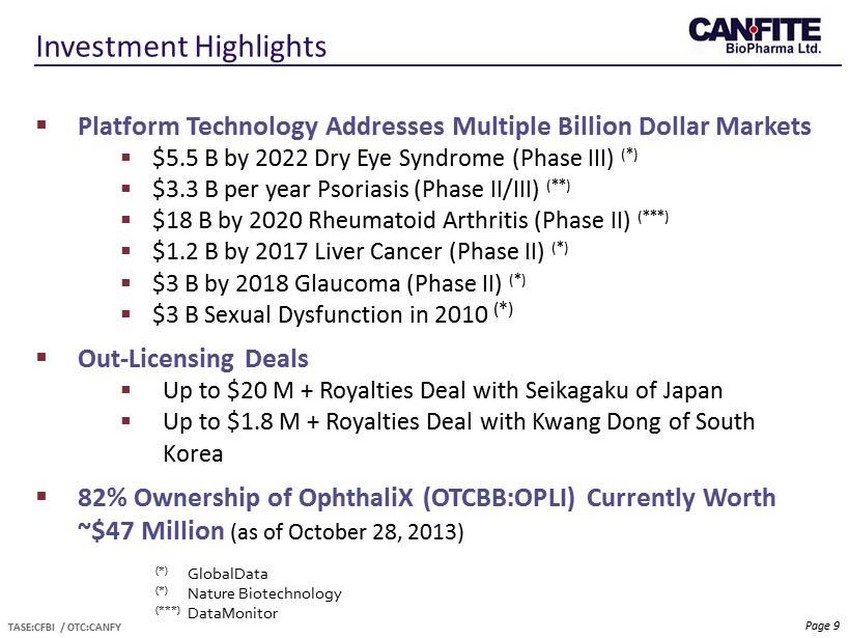

Page 9 Investment Highlights TASE:CFBI / OTC:CANFY ▪ Platform Technology Addresses Multiple Billion Dollar Markets ▪ $ 5.5 B by 2022 Dry Eye Syndrome (Phase III ) ( * ) ▪ $ 3.3 B per year Psoriasis (Phase II/III) ( ** ) ▪ $ 18 B by 2020 Rheumatoid Arthritis (Phase II) ( *** ) ▪ $ 1.2 B by 2017 Liver Cancer (Phase II) ( * ) ▪ $ 3 B by 2018 Glaucoma (Phase II) ( * ) ▪ $ 3 B Sexual Dysfunction in 2010 ( * ) ▪ Out - Licensing Deals ▪ Up to $ 20 M + Royalties Deal with Seikagaku of Japan ▪ Up to $ 1.8 M + Royalties Deal with Kwang Dong of South Korea ▪ 82 % Ownership of OphthaliX (OTCBB:OPLI) Currently Worth ~$ 47 Million (as of October 28 , 2013 ) (*) GlobalData (*) Nature Biotechnology (***) DataMonitor

Page 10 Corporate Partnerships ▪ Tokyo Stock Exchange (Ticker:4548) ▪ Exclusive license to develop and commercialize CF101 in Japan ▪ Up to $20 M in upfront and milestone payments plus up to 12% royalties . Such payments are subject to development and marketing milestones. To date $7.5M has been received ▪ South Korean Stock Exchange (Ticker: A009290) ▪ Exclusive license to develop and commercialize CF101 for the treatment of rheumatoid arthritis in Korea ▪ $1.8 M in upfront and milestone payments plus up to 7% royalties . Such payments are subject to development and marketing milestones. To date $0.8M has been received ▪ Purchased 1% of Can - Fite’s outstanding shares ▪ U.S. OTCQB (Ticker: OPLI) ▪ Can - Fite holds 82 % ownership; OphthaliX market cap ~47M (as of October 28, 2013) ▪ Can - Fite spun - off all ophthalmic indications of CF101 into OphthaliX

Page 11 Ophthalmology Spin - off ▪ Can Fite spun - off all ophthalmic indications of CF101 to OphthaliX ▪ Traded on the OTCQB (Ticker: OPLI ) ▪ Current market cap ~$47M (as of October 28, 2013) ▪ Can - Fite holds 82% of OphthaliX

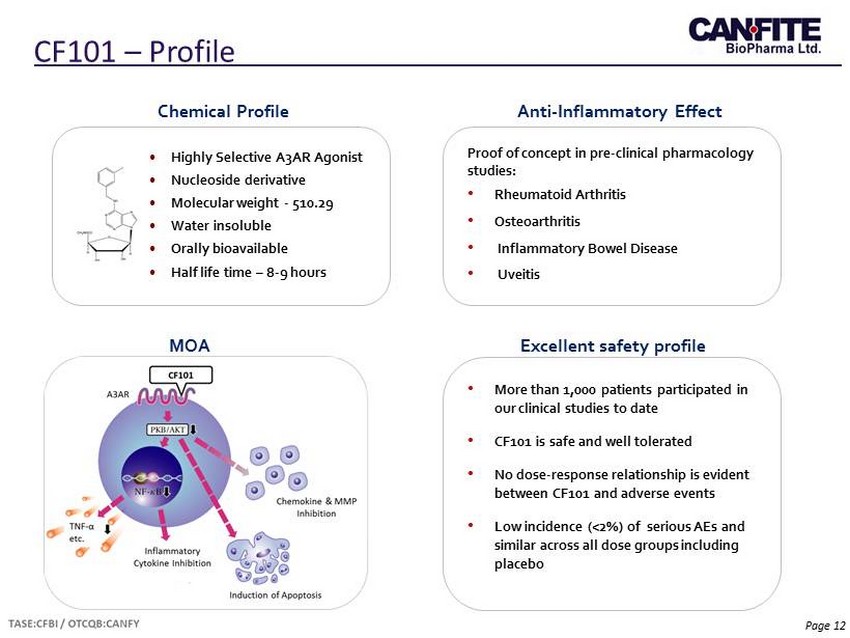

Page 12 CF101 – Profile • Highly Selective A 3 AR Agonist • Nucleoside derivative • Molecular weight - 510.29 • Water insoluble • Orally bioavailable • Half life time – 8 - 9 hours Chemical Profile Proof of concept in pre - clinical pharmacology studies: • Rheumatoid Arthritis • Osteoarthritis • Inflammatory Bowel Disease • Uveitis Anti - Inflammatory Effect MOA Excellent safety profile • More than 1,000 patients participated in our clinical studies to date • CF101 is safe and well tolerated • No dose - response relationship is evident between CF101 and adverse events • L ow incidence (<2%) of serious AEs and similar across all dose groups including placebo

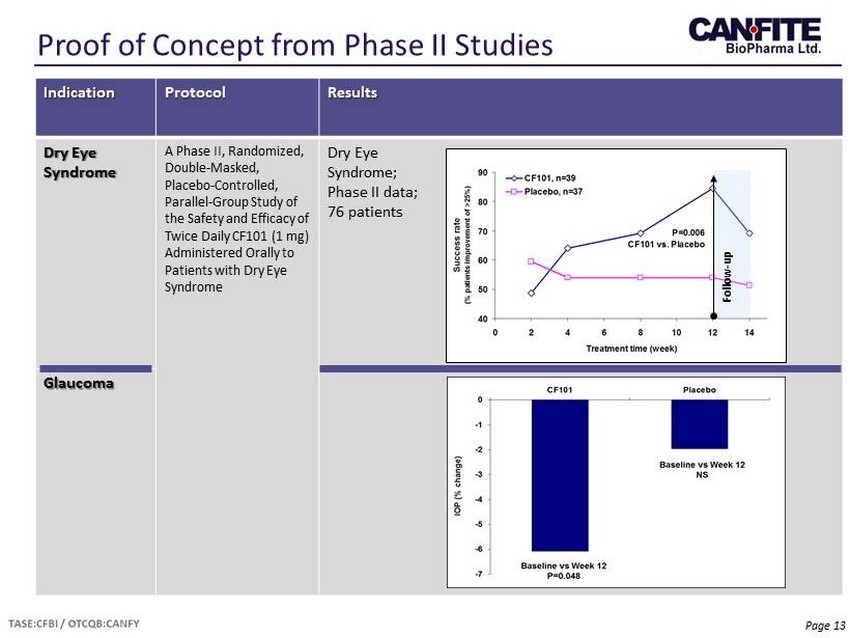

Page 13 Proof of Concept from Phase II Studies Indication Protocol Results Dry Eye Syndrome A Phase II, Randomized, Double - Masked, Placebo - Controlled, Parallel - Group Study of the Safety and Efficacy of Twice Daily CF101 (1 mg) Administered Orally to Patients with Dry Eye Syndrome Dry Eye Syndrome; Phase II data ; 76 patients Glaucoma Follow - up

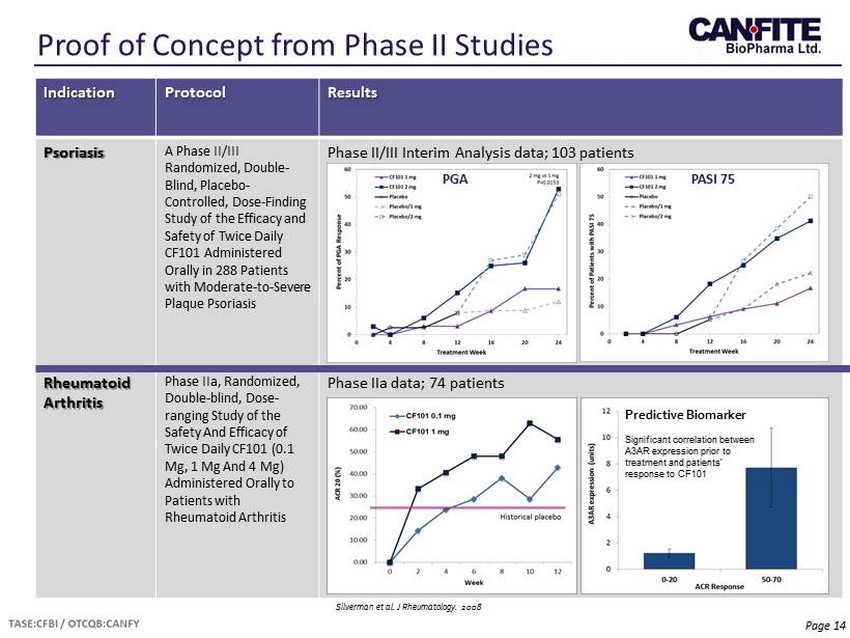

Page 14 Proof of Concept from Phase II Studies Indication Protocol Results Psoriasis A Phase II/III Randomized, Double - Blind, Placebo - Controlled, Dose - Finding Study of the Efficacy and Safety of Twice Daily CF101 Administered Orally in 288 Patients with Moderate - to - Severe Plaque Psoriasis Phase II/III Interim Analysis data; 103 patients Rheumatoid Arthritis Phase IIa , Randomized, Double - blind, Dose - ranging Study of the Safety And Efficacy of Twice Daily CF101 (0.1 Mg, 1 Mg And 4 Mg) Administered Orally to Patients with Rheumatoid Arthritis Phase IIa data; 74 patients PGA PASI 75 Predictive Biomarker Significant correlation between A3AR expression prior to treatment and patients’ response to CF101 Silverman et al. J Rheumatology. 2008

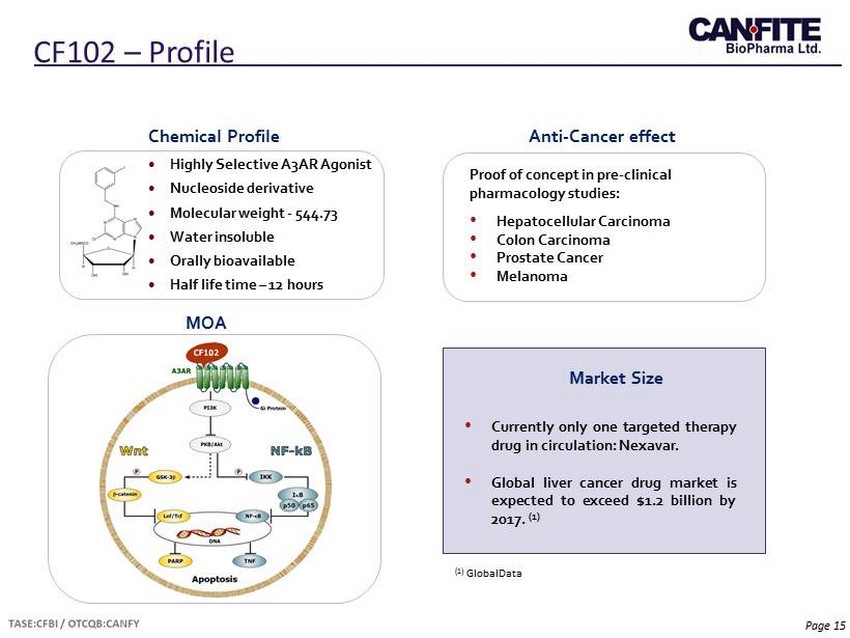

Page 15 CF102 – Profile • Highly Selective A3AR Agonist • Nucleoside derivative • Molecular weight - 544.73 • Water insoluble • Orally bioavailable • Half life time – 12 hours Chemical Profile Proof of concept in pre - clinical pharmacology studies: • Hepatocellular Carcinoma • Colon Carcinoma • Prostate Cancer • Melanoma Anti - Cancer effect MOA Market Size • Currently only one targeted therapy drug in circulation : Nexavar . • Global liver cancer drug market is expected to exceed $ 1 . 2 billion by 2017 . ( 1 ) (1) GlobalData

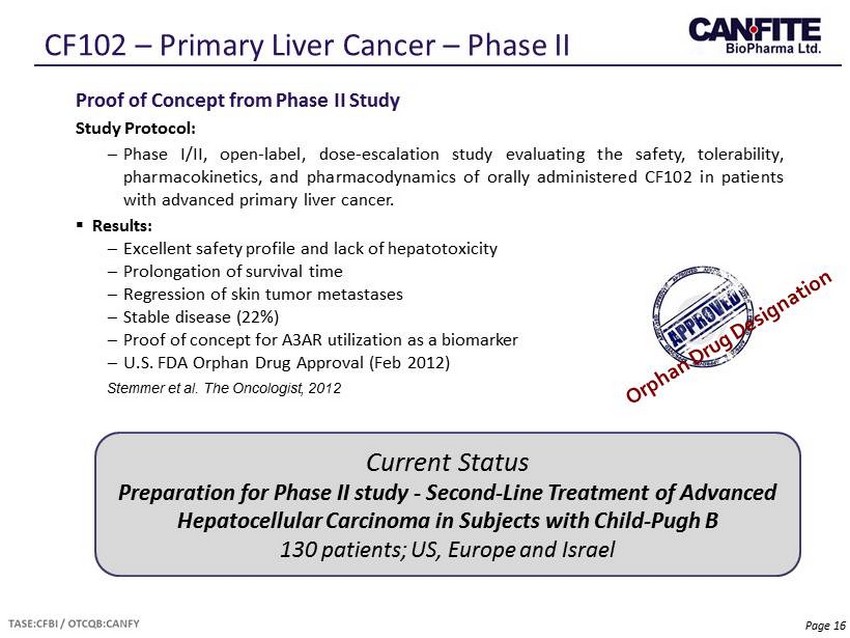

Page 16 CF102 – Primary Liver Cancer – Phase II Proof of Concept from Phase II Study Study Protocol: – Phase I/II, open - label, dose - escalation study evaluating the safety, tolerability, pharmacokinetics, and pharmacodynamics of orally administered CF 102 in patients with advanced primary liver cancer . ▪ Results: – Excellent safety profile and lack of hepatotoxicity – Prolongation of survival time – Regression of skin tumor metastases – Stable disease (22%) – Proof of concept for A3AR utilization as a biomarker – U.S. FDA Orphan Drug Approval (Feb 2012) Stemmer et al. The Oncologist, 2012 Current Statu s Preparation for Phase II study - Second - Line Treatment of Advanced Hepatocellular Carcinoma in Subjects with Child - Pugh B 130 patients; US, Europe and Israel

Page 17 Intellectual Property Portfolio ▪ Exclusive licensee of the U.S. National Institutes of Health (NIH) and Leiden University in the Netherlands for patents covering A3AR Agonists ▪ 15 patent families ▪ 150 patents issued and pending patents applications internationally ▪ IP covers composition of matter, synthesis of matter, and clinical applications

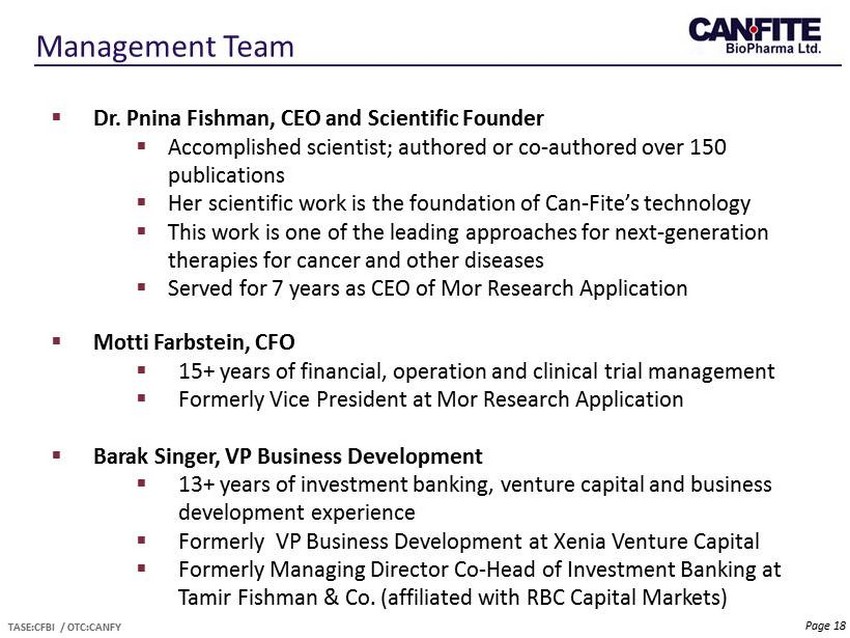

Page 18 Management Team TASE:CFBI / OTC:CANFY ▪ Dr. Pnina Fishman, CEO and Scientific Founder ▪ Accomplished scientist; authored or co - authored over 150 publications ▪ Her scientific work is the foundation of Can - Fite’s technology ▪ This work is one of the leading approaches for next - generation therapies for cancer and other diseases ▪ Served for 7 years as CEO of Mor Research Application ▪ Motti Farbstein , CFO ▪ 15+ years of financial, operation and clinical trial management ▪ Formerly Vice President at Mor Research Application ▪ Barak Singer, VP Business Development ▪ 13+ years of investment banking, venture capital and business development experience ▪ Formerly VP Business Development at Xenia Venture Capital ▪ Formerly Managing Director Co - Head of Investment Banking at Tamir Fishman & Co . (affiliated with RBC Capital Markets)

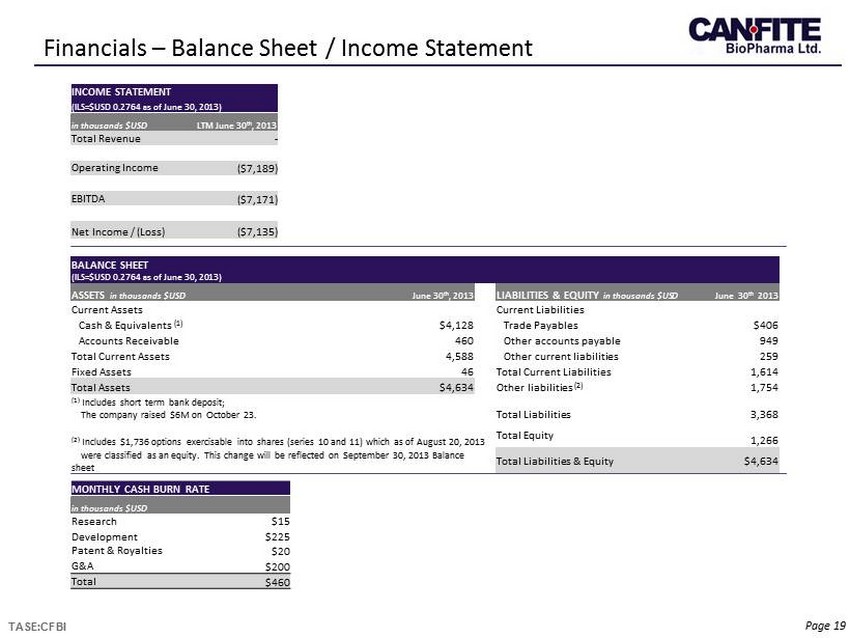

Page 19 Financials – Balance Sheet / Income Statement TASE:CFBI BALANCE SHEET (ILS=$USD 0.2764 as of June 30, 2013) ASSETS in thousands $USD June 30 th , 2013 LIABILITIES & EQUITY in thousands $USD June 30 th 2013 Current Assets Current Liabilities Cash & Equivalents (1) $4,128 Trade Payables $406 Accounts Receivable 460 Other accounts payable 949 Total Current Assets 4,588 Other current liabilities 259 Fixed Assets 46 Total Current Liabilities 1,614 Total Assets $4,634 Other liabilities (2) 1,754 (1) Includes short term bank deposit; The company raised $6M on October 23. Total Liabilities 3,368 (2) Includes $1,736 options exercisable into shares (series 10 and 11) which as of August 20, 2013 Total Equity 1,266 were classified as an equity. This change will be reflected on September 30, 2013 Balance sheet Total Liabilities & Equity $4,634 INCOME STATEMENT (ILS=$USD 0.2764 as of June 30, 2013) in thousands $USD LTM June 30 th , 2013 Total Revenue - Operating Income ($7,189) EBITDA ($7,171) Net Income / ( Loss) ($ 7,135) MONTHLY CASH BURN RATE in thousands $USD Research $15 Development $225 Patent & Royalties $20 G&A $200 Total $460

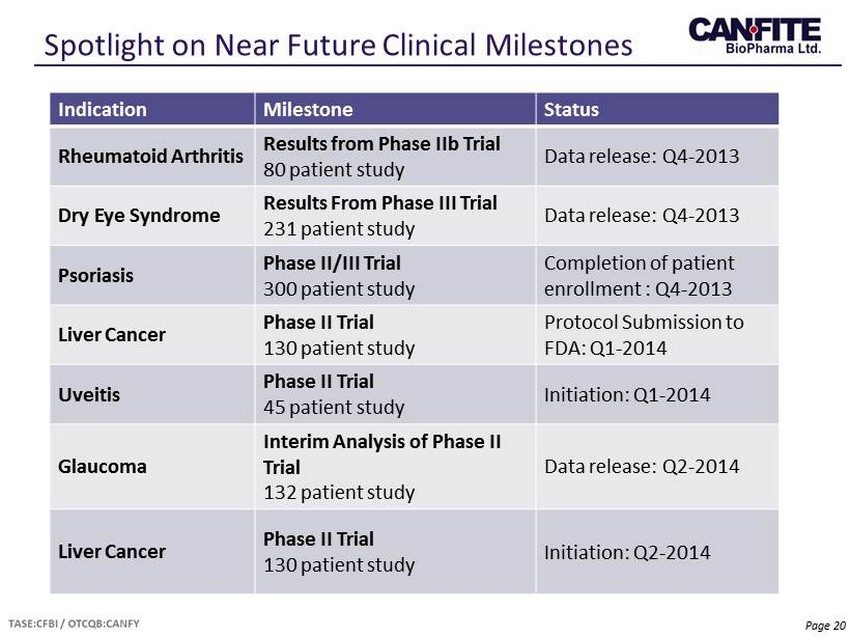

Page 20 Spotlight on Near Future Clinical Milestones Indication Milestone Status Rheumatoid Arthritis Results from Phase II b Trial 80 patient study Data release: Q4 - 2013 Dry Eye Syndrome Results From Phase III Trial 231 patient study Data release: Q4 - 2013 Psoriasis Phase II/III Trial 300 patient study Completion of patient enrollment : Q4 - 2013 Liver Cancer Phase II Trial 130 patient study Protocol Submission to FDA: Q1 - 2014 Uveitis Phase II Trial 45 patient study Initiation: Q1 - 2014 Glaucoma Interim Analysis of Phase II Trial 132 patient study Data release: Q2 - 2014 Liver Cancer P hase II Trial 130 patient study Initiation: Q2 - 2014